Release notes

2025-07-02

Added

- Guide for SEPA Batch Transfers

Deleted

- Missleading NOTE deleted from BKYC guied

2025-07-01

Added

- New section created for B2B review fields AML-update-process

- Added new Guide for Scheduled Transfers with SEPA

- Added new Webhook for status change during Scheduled Transfers

Changed

- Added section Business Customers (B2B) under AML-update-process

- Updated API specifications for Verification of Payee

- Updated API specifications for Scheduled Transfers

2025-06-27

- Verification of Payee Guide : Added Verification of Payee Guide

- Update Sepa Instant Limits : Updated the request body for Sepa Instant Limits.

- Sepa Instant limits Guide : Added Guide for Sepa Instant limits

2025-06-24

- Updated

aml_confirmed_onandbirth_cityfor AML Sandbox testing - Retrieve a card spending limit control (V2): Added field

positive_balance_limitin the request

2025-05-28

- Added a new field for Verification of Payee for Sepa Credit transfer

- Added a new field for Verification of Payee for Sepa Instant Credit transfer

- Added a new field Verification of Payee for Scheduled Transfers

- Added a new field Verification of Payee for Scheduled Transfers

2025-05-23

- Person identification: New identificaton method

idnow_customadded - Added a new webhook event TRUSTED_IBAN_CONFIRMED

- Added new API for Verification of Payee

2025-04-17

Added

- Create card spending limit control (V2): Added field

positive_balance_limitin the request - Index card spending limit controls (V2): Added field

positive_balance_limitin the response - Account opening endpoints: Added

SAVINGS_ACCOUNT_EXTERNAL_REFERENCE_CONSUMER_GERMANYas possible product name andSAVINGS_PERSONAL_EXTERNAL_REFERENCEas possible account type - Autoident Guide: Added new guide for Autoident identification for re-KYC purposes

- Identification endpoints: Added new method

idnow_autoidentfor relared person identification endpoints - Added a new webhook event CARD_DELIVERY_TRACKING

- Batch Transfers:Added new API for Batch Transfers to comply with SEPA regulations.

- Scheduled Transfers:Added new API for Scheduled Transfers to comply with SEPA regulations.

- Sepa Instant Limits:Added new API to configure Sepa Instant Limits to comply with SEPA regulations.

- [Retrieve SEPA Credit transfers] Added a new API to retrieve SEPA Credit transfers using various filters [Now deleted]

2025-03-28

Added

- Add Annual Turnover : Added a new API end point to collect the Annual Turnover for Businesses.

Changed

- GET Account bookings: Updated the card related metainfo to indicate transactionid

- Create a Person: Updated the requirement for the last_name field to indicate an empty last name with N/A

- Index accounts: Limit page size to max of 200

- Search for business's commercial registration: Added missing field

commercial_registry_industry_keyin the response - Appendix III: Testing samples for GET Search for business commercial registratio: Updated testing samples

2025-03-14

Added

- POST Initiate a payout to a reference account: New reference payout endpoint that combines both person and business payouts.

Changed

- Safeguarding Accounts: Updated with the new reference account endpoint

- Decoupled cards for consumers: Updated with the new reference account endpoint

- Restricted accounts: Updated with the new reference account endpoint

- Document collection: Updated section about required documents for freelancers

- GET Business : Updated the field for AML follow up date for Businesses

- Initiate account closure request: Fixed mistake in the endpoint response. Changed

payout_allowedfromstringtoboolean - Execute a transfer request: Removed non existing field

end_to_end_idfrom the response - GET Tax Exemption : Removed reference field from the Response

2025-02-18

Changed

- Index accounts for a person: Update missing datapoint

2025-02-04

Added

- Account Opening: Added new validations rules to account opening.

2024-12-30

Added

- Safeguarding Accounts: Added a new guide for the new safeguarding accounts product. Check this guide for more information on the key features of the product and how to integrate it into your solution.

-

SDD notifications: Added a new feature for SDD notifications, which allows you to fetch pending SDDs and trigger notifications for your customers before the SDD execution date. The feature includes a new endpoint and a webhook event:

Changed

- GET Index account bookings: Added a new booking type

SepaInstantCreditTransferReturn. -

POST Create an account opening request: Added new values for the field

product_name. The new values are for the subaccounts product and include the following:- SUBACCOUNT_CONSUMER_FRANCE

- SUBACCOUNT_CONSUMER_GERMANY

- SUBACCOUNT_CONSUMER_ITALY

- SUBACCOUNT_CONSUMER_SPAIN

- SUBACCOUNT_BUSINESS_FRANCE

- SUBACCOUNT_BUSINESS_GERMANY

- SUBACCOUNT_BUSINESS_ITALY

- SUBACCOUNT_BUSINESS_SPAIN

- SUBACCOUNT_FREELANCER_FRANCE

- SUBACCOUNT_FREELANCER_GERMANY

- SUBACCOUNT_FREELANCER_ITALY

- SUBACCOUNT_FREELANCER_SPAIN The following values have been removed:

- SUBACCOUNT_FRANCE

- SUBACCOUNT_GERMANY

- SUBACCOUNT_ITALY

- SUBACCOUNT_SPAIN

2024-12-17

Added

-

- Added a new endpoint POST Request the utilization details of a person's tax exemption order to request tax exemption utilization details for an account.

- Added a new webhook event TAX_EXEMPTION_UTILIZATION

Changed

- POST Create a business: Added a missing field to the request body

nace_code. - Legal and Compliance Screens guide: Updated the legal text of FATCA indication screens for B2B customers for Digital Banking & Cards product, including new screens on how to collect the FATCA indication for the business's legal representatives and beneficial owners.

-

Savings Accounts: Updated the enum values for the field

statusin the response body of the following resources to include a new statusFAILED:

2024-10-18

Added

- Business resource creation on Sandbox: When creating businesses on Sandbox, please ensure that each business you create has unique values for the following fields

name,postal_code,legal_form, andregistration_number(if provided) to avoid receiving a 400 error.

Changed

-

CARD_AUTHORIZATION webhook event:

- Updated the webhook payload to add missing fields. New fields added include

partner_id,fx_markup,issuer_feein themeta_object. - Changed the

meta_infofield to be JSON-serialized object. - Updated the enum values possible for the field

pos_entry_modeto include the following values:ECOMMERCE,CREDENTIAL_ON_FILE,MANUAL_PAN_ENTRY,CONTACTLESS,UNKNOWN,CHIP,MAG_STRIPE.

- Updated the webhook payload to add missing fields. New fields added include

- POST Create a person: Added a note that disabling certain partner settings will restrict the number of NACE codes available.

2024-09-24

Changed

- Bankident guide: Updated the flow diagram to include an additional SCHUFA check done in the beginning with the customer's data to determine their eligibility.

- GET Retrieve business registration number and issuer: Updated the response to an array of objects instead of a single object.

- GET Search for business's commercial registration: Updated the type of the field

legal_representativesto an array of objects instead of a single object. - Data collection: Removed the field

data_terms_signed_atfrom the mandatory data points for businesses in all branches and products.

2024-09-13

Added

- POST Request fee summary statement: Added a new endpoint to request the creation of a fee summary statement. The guides Account management and Postbox have been updated accordingly.

- Cards API: New API endpoint: GET Retrieve card delivery tracking

Changed

- CARD_FRAUD_CASE_TIMEOUT webhook event: Updated the webhook payload to fix the example values for the field

amountandoriginal_amount. - CARD_FRAUD_CASE_PENDING webhook event: Updated the webhook payload to fix the example values for the field

amountandoriginal_amount. - POST Create an identification endpoint: Updated the possible values of the field

idnow_process_typeto includenull. - GET Retrieve a person's tax exemption status endpoint: Added new enum values to the

statusresponse property:INACTIVE,DELETED,EXPIRED,INVALID. Removed theCLOSEDenum value.

Deleted

- Removed API endpoints related to the legacy Securities Brokerage product.

2024-08-16

Added

- SEPA Instant Credit Transfers guide: Added a new section with instructions for testing on Sandbox.

2024-08-09

Added

-

Savings Account API: New endpoints added:

2024-08-01

Added

-

Added new headers to the

200response of the endpoints listed below:Total,Per-Page,Link - POST Create a fee collection transaction: New request property:

valuta_date - Device management API: Added more details and enum values to all

4xxresponses.

2024-07-30

Added

- Cards API: New endpoint added: GET Index card transactions

-

Postbox API: Added new endpoints for testing Postbox:

- API reference - Standards guide: Added a new section to the SEPA characters guide around replacing non-standard Latin characters in customer names according to European Payment Council guidelines.

Changed

- Instant SCT guide: Updated the requirements to indicate that supporting incoming Instant SCTs will be mandatory starting from 09.01.2025.

-

Postbox API: Marked the following Postbox testing APIs as deprecated:

2024-07-05

Changed

- Freelancer Overdrafts Guide: Added a note about the validations done upon overdraft termination request.

2024-05-31

Changed

- BKYC guide and Onboard a Business guide: Updated the compliance questions section and added details on how to handle required compliance documents.

2024-05-28

Changed

- Cards creation and servicing guide: Removed the deprecated "Report a card as lost/stolen" endpoint from the card status flow diagrams and their accompanying descriptions.

2024-05-27

Added

- Account closure guide: Added a hint that you may only close a customer's account with the reason

account_revocationwithin 14 days of the account opening.

Changed

- ACCOUNT_OPENING_REQUEST webhook event: Changed the

errorresponse property to an object that contains the propertiescodeanddetail. - SEPA_TIMED_ORDER webhook event: Updated the time format of the

processed_atproperty. - GET Index reservations on an account. Version 2022-07-18: The

meta_infoproperty is no longer enclosed in acardsobject and is now returned at the same level as all the other response properties. - Instant Top-Ups guide: Corrected the Top-Up status values in the flow diagram resulting from the success/failure of the Top-Up.

2024-05-06

Changed

- AML update process guide: Changed the review cycle for high-risk customers in Germany from "once every two years" to "yearly."

- Mandatory features guide, Credit cards guides: Added a note that partners should not implement the Account Closure feature in their solutions if they use credit cards and do not use Digital Banking accounts.

Deleted

- Card creation & servicing guide: Removed the statement that you can only create up to five virtual cards per customer.

2024-04-24

Changed

- Account Closure guide: Fixed an error in the guide in a webhook event name from

ACCOUNT_CLOSURE_STATUS_UPDATEto the correct nameACCOUNT_CLOSURE_REQUEST_UPDATE. Updated the flow diagrams accordingly with the correct names.

2024-04-19

Changed

- Business Onboarding requirements: The fields

terms_and_conditions_signed_atanddata_terms_signed_atare removed from the mandatory data points required for legal representatives and authorized persons. These fields are only needed for the business as a legal entity. - DELEGATESCACANCEL: Added a note that this webhook event is not relevant for the new 3DS flow using change request. It's used only for the old flow, which will be deprecated soon.

- POSTBOX item response: Updated the description of the fields

customer_notificationandcustomer_confirmation.

2024-04-15

Changed

- Account Closure guide: Restructured the guide and add flow diagrams for different ACR types. Please note that automated account closures are now a mandatory feature.

- ACCOUNTCLOSUREREQUEST webhook: Updated the example value of the field

updated_atto the correct format. - BOOKING webhook: Updated the example value of the field

recorded_atto the correct format.

2024-03-28

Added

- Consumer Splitpay: Added additional information about the different events that trigger credit line webhook events.

- Freelancer Overdrafts: Added a new endpoint to request the termination of a freelancer overdraft.

Changed

- Customer Due Diligence: Corrected the color of the following CDD statuses to be yellow:

NOT_SCORED,NOT_SCREENED, andNOT_VETTED. Adjusted also the appendix accordingly. -

Consumer Overdrafts API: Updated the response payload of the following endpoints to include new values for the field overdraft

status. New values:defaulted_pending,conditions_termination_pendingandtermination_pending: - Securities purchases API: Marked these endpoints as deprecated, as they correspond with a legacy product that Solaris no longer offers.

2024-03-22

Changed

- Card creation & servicing guide: Synchronized the instructions for replacing a card/reporting a card as lost or stolen with the description in the API reference.

- Card tokenization APIs: Renamed the "Visa tokens servicing" API reference subsection to "Card token servicing."

- PSD2 guide: To comply with PSD2 regulations, you need to implement app-to-app redirection if a user is using a TPP mobile app, and also has a banking app installed. The user must be redirected to the banking app to perform the 1FA login. The guide has been updated with implementation recommendations, as well as the user flow.

2024-03-06

Added

-

POST Create an account opening request: Added new

product_namevalues for the Savings Account product and values with specific product/customer/branch naming:DECOUPLED_CARD_CONSUMER_GERMANYEMONEY_ACCOUNT_BUSINESS_GERMANYEMONEY_ACCOUNT_CONSUMER_GERMANYEMONEY_ACCOUNT_FREELANCER_GERMANYRESTRICTED_ACCOUNT_BUSINESS_GERMANYSAVINGS_ACCOUNT_CONSUMER_FRANCESAVINGS_ACCOUNT_BUSINESS_FRANCESAVINGS_ACCOUNT_FREELANCER_FRANCESAVINGS_ACCOUNT_CONSUMER_GERMANYSAVINGS_ACCOUNT_BUSINESS_GERMANYSAVINGS_ACCOUNT_FREELANCER_GERMANYSAVINGS_ACCOUNT_CONSUMER_ITALYSAVINGS_ACCOUNT_BUSINESS_ITALYSAVINGS_ACCOUNT_FREELANCER_ITALYSAVINGS_ACCOUNT_CONSUMER_SPAINSAVINGS_ACCOUNT_BUSINESS_SPAINSAVINGS_ACCOUNT_FREELANCER_SPAIN

Deleted

-

POST Create an account opening request: Removed

product_namevalues that do not include product + customer + country:DECOUPLED_CARD_CONSUMERDECOUPLED_CARD_BUSINESSEMONEY_ACCOUNT_CONSUMEREMONEY_ACCOUNT_FREELANCEREMONEY_ACCOUNT_BUSINESSRESTRICTED_ACCOUNT_BUSINESS

2024-03-04

Added

-

New product: Savings Accounts (Tagesgeld)

Changed

- Card spending controls API: Corrected the name of a property in the V2 card spending control limit endpoints from

exclusion_dimensiontoexcluded_dimension.

Deleted

- All documentation around Solaris Digital Assets has been removed.

2024-02-20

Added

- New webhook event: CREDIT_CARD_BILL

-

Card spending controls: Solaris has released V2 of the card spending limit controls endpoints. The card spending controls guide has been updated with instructions on how to use these new endpoints.

Changed

- POST Create a secure view for card details: Added more instructions for generating the

signature. The API reference now contains more details on how to generate a single string from thejwk_keyrepresentation of the public part of thersa_key.

2024-01-22

Changed

- Postbox Items endpoints: Updated the description of the field

customer_confirmationin the endpoint response. - Booking types: Corrected the name of the

SepaInstantCreditTransferbooking type value toSEPAInstantCreditTransfer.

Deleted

- GET Index all accounts: Removed the

uidfilter. Onlyidis available now.

2024-01-05

Changed

- Updated the reference link for the values of the

nace_codefield to include an up-to-date website that lists the values in multiple languages. - POST Fetch activation payload for Apple Pay in-app verification: Updated the

201response body to include theactivation_payloadwrapper for theactivation_datapayload.

2023-12-22

Changed

-

Synchronized the contents of the

meta_infoobject across the following endpoints and webhook events: - CARD_TOKEN_LIFECYCLE webhook event: Updated the description of the

visa_pan_reference_idproperty to clarify that this property is only included for webhook notifications related to VISA cards, and that this property is deprecated in favor of thepan_reference_idproperty. - SCA_CHALLENGE webhook event: Updated the description to clarify that this webhook event will only notify you when a customer makes a purchase that requires 3DS authentication.

2023-12-08

Added

- Person documents API: New endpoint added: (Sandbox only) Trigger account block or send notification due to outdated identity document

2023-12-01

Changed

- PATCH Cancel a timed order: Corrected the endpoint description and responses—this endpoint does not trigger a Change Request.

- POST Create standing order: Corrected the name of a possible value of the

transaction_typeenum property fromSEPA_CREDIT_TRANSFERtoSEPA_CREDIT_TRANSACTION. - POST Create a credit clearing transaction: Updated the enum values of

booking_typeto show only those that are allowed for credit clearing transactions.

Deleted

- POST Validate an IBAN: The API no longer returns the properties

bank_codeandaccount_numberin the response.

2023-11-24

Added

- 3DS guide: Added a new step about declining a 3DS challenge without the change request process using the POST Decline 3DS authentication endpoint.

- Push provisioning APIs: New API endpoint: POST Fetch activation payload for Apple Pay in-app verification

- PUT Verify device signing challenge: Added a missing description for the field

idin the path parameters. The fieldidrefers to the challenge ID.

Changed

- Renamed the Card push provisioning guide to Card tokenization & push provisioning. Note that the URL has not changed. We also updated the introductory section with more context around tokenization and push provisioning.

-

Push provisioning APIs: Renamed the following API endpoints:

- "POST Add a card to a Apple Pay wallet" → POST Fetch wallet payload for Apple Pay in-app provisioning

- "POST Add a card to a Google Pay wallet" → POST Fetch wallet payload for Google Pay in-app provisioning

- "POST Add a card to a Samsung Pay wallet" → POST Fetch wallet payload for Samsung Pay in-app provisioning

- Strong Customer Authentication guide: Updated step 2 in the device signing section to fix the path URL to

PUT /mfa/challenges/devices/{id}instead ofPUT /mfa/challenges/devices/{device_id}. Added a note thatidrefers to the challenge ID.

2023-11-10

Added

- BKYC guide: Added the field

country(to denote the customer's country of residence) as a mandatory field when creating a person resource for the beneficial owner of a business. - Credit cards guides: Added a section to each guide on credit card termination.

-

Credit cards API: Added new endpoints related to credit card termination:

-

Instant Card Top-ups guide: Added two new sections:

- Passing the customer's billing address to Stripe (Note: this new section is required for top-up implementations)

- Apple Pay integration

Changed

- Bankident guides: Updated the testing section with new examples for the POST Create a person endpoint.

- Business Overdrafts guide: Reviewed the guide and made the language more concise.

- Cards tokenization - Visa tokens servicing API: Corrected the name of the

token_statusproperty returned by the API tostatus.

2023-11-03

Added

- GET Retrieve an identification: Added a new property

idnow_process_typeto specify which IDnow identification method is used. Possible values areeidandvideo. - POST Create a SEPA Direct Debit refund: Added a new validation for SDD refunds. The transaction will fail if the account is inactive.

2023-10-31

Added

- GET List account bookings: Added the full list of enum values returned by the API for the

sepa_return_codeproperty on the booking resource.

Changed

- POST Replace a card: Updated the endpoint description to indicate which card

statusvalues are required for the "reissue," "replace," and "lost/stolen" use cases, respectively.

2023-10-30

Added

- You can now subscribe to the Solaris API docs newsletter to receive e-mail notifications whenever updates are published to this site. Scroll down to the bottom of any page on this site to find the sign-up form.

2023-10-20

Added

- Account management guide: Added a note that overdraft information shown in an account statement represents the status of the overdraft on the date the statement was generated. Partners need to include this as well in statements shared with the end customers.

Changed

- POST Create an Instant SEPA Credit Transfer: Changed the field

descriptiontooptionalinstead ofrequired. - Strong Customer Authentication guide: Corrected the key pair required for card secure view use case to

unrestrictedinstead of restricted.

2023-10-18

Added

- BKYC guide: Reorganized the list of required documents per legal form and mapped each required document to its related enum value.

- Account closure requests API: Added a new enum value for

closure_reason:TECHNICAL_IMMEDIATE_INTERNAL - PATCH Request an identification: Added a new error 400 for errors occurring on the client side for IDnow.

Changed

- API reference: Fixed instances where API error responses would include the

detailsproperty instead ofdetail.

2023-10-10

Changed

- Freelancer Overdrafts guide: Reviewed the guide and made language changes to make the guide more concise and added new status flow diagram.

2023-09-28

Changed

-

[

meta_infofield]: Corrected the JSON-serializedmeta_infofield to embed it in an object. It has changed from'{\"card_id": "string",---to{\"cards\":{\"card_id\":---. The impacted endpoints and webhooks are as follows: -

Index reservations on an account. Version 2022-07-18: Updated the endpoint's query parameters, the following parameters have changed:

filter[reservation_type]changed tofilter[type].reservation_typefield changed totype.- reservation_type enum list have changed.

2023-09-22

Changed

-

Consumer Overdrafts guide: Reviewed the guide and made language changes to make the guide more concise and added new diagrams. Added the following sections:

- Overdraft limit change requests: Added a new section to explain the limit change request process and related endpoints.

- [Overdraft limit change request status]: Added a new appendix for the status values and a new status flow diagram.

2023-09-04

Added

-

Onboarding requirements - Legal and compliance screens:

- FATCA indication: Added a German translation of the B2B FATCA indication text.

- Compliance disclaimer screen: Added English & German texts for B2B customers.

- Video identification (IDnow) guide: Added an appendix explaining each scenario of IDnow status transitions.

Changed

-

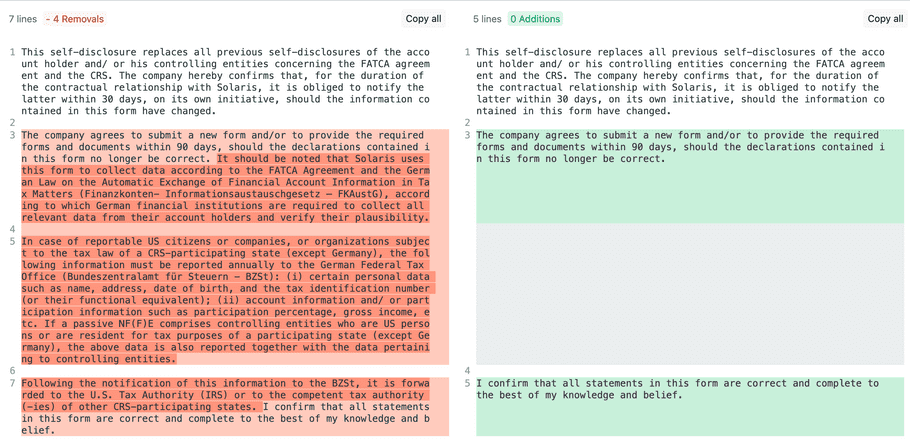

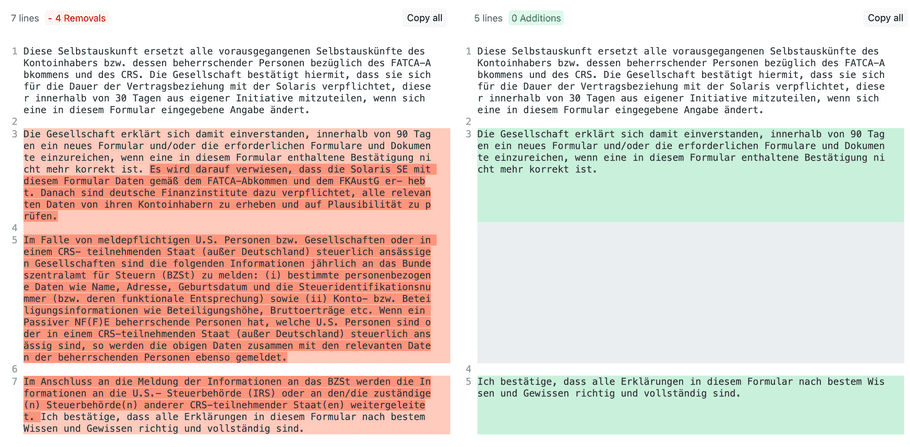

Onboarding requirements - Legal and compliance screens: Removed text related to FATCA reporting from the business tax declaration text. The screenshots below show a comparison of the previous vs. current versions, with the removed text highlighted in red. The removed text is also provided below.

-

English:

It should be noted that Solaris uses this form to collect data according to the FATCA Agreement and the German Law on the Automatic Exchange of Financial Account Information in Tax Matters (Finanzkonten- Informationsaustauschgesetz – FKAustG), according to which German financial institutions are required to collect all relevant data from their account holders and verify their plausibility.

In case of reportable US citizens or companies, or organizations subject to the tax law of a CRS-participating state (except Germany), the following information must be reported annually to the German Federal Tax Office (Bundeszentralamt für Steuern - BZSt): (i) certain personal data such as name, address, date of birth, and the tax identification number (or their functional equivalent); (ii) account information and/ or participation information such as participation percentage, gross income, etc. If a passive NF(F)E comprises controlling entities who are US persons or are resident for tax purposes of a participating state (except Germany), the above data is also reported together with the data pertaining to controlling entities.

Following the notification of this information to the BZSt, it is forwarded to the U.S. Tax Authority (IRS) or to the competent tax authority (-ies) of other CRS-participating states. -

German:

Es wird darauf verwiesen, dass die Solaris SE mit diesem Formular Daten gemäß dem FATCA-Abkommen und dem FKAustG er- hebt. Danach sind deutsche Finanzinstitute dazu verpflichtet, alle relevanten Daten von ihren Kontoinhabern zu erheben und auf Plausibilität zu prüfen. Im Falle von meldepflichtigen U.S. Personen bzw. Gesellschaften oder in einem CRS- teilnehmenden Staat (außer Deutschland) steuerlich ansässigen Gesellschaften sind die folgenden Informationen jährlich an das Bundeszentralamt für Steuern (BZSt) zu melden: (i) bestimmte personenbezogene Daten wie Name, Adresse, Geburtsdatum und die Steueridentifikationsnummer (bzw. deren funktionale Entsprechung) sowie (ii) Konto- bzw. Beteiligungsinformationen wie Beteiligungshöhe, Bruttoerträge etc. Wenn ein Passiver NF(F)E beherrschende Personen hat, welche U.S. Personen sind oder in einem CRS-teilnehmenden Staat (außer Deutschland) steuerlich ansässig sind, so werden die obigen Daten zusammen mit den relevanten Daten der beherrschenden Personen ebenso gemeldet. Im Anschluss an die Meldung der Informationen an das BZSt werden die Informationen an die U.S.- Steuerbehörde (IRS) oder an den/die zuständige(n) Steuerbehörde(n) anderer CRS-teilnehmender Staat(en) weitergeleitet.

-

- OVERDRAFT_LIMIT_CHANGE webhook payload: Changed the webhook event payload.

2023-08-31

Changed

-

Cards creation and servicing: The POST Report a card as lost/stolen endpoint has been deprecated. Partners are advised to use the POST Replace a card endpoint to report a card as lost/stolen. The POST Replace a card endpoint description has been updated with instructions on how to use the endpoint for each use case.

- The card creation and servicing guide has been updated accordingly.

2023-08-29

Added

- Customer Due Diligence guide: Added a new section to describe the CDD flow for B2B lending products.

- Business Fronting Loans guide: Added a new step for Customer Due Diligence.

- Business Fronting Factoring guide: Added a new step for Customer Due Diligence.

- Trade Finance guide: Added a new step for Customer Due Diligence.

2023-08-25

Added

- Cards API: New endpoint: POST /v1/cards/3ds/{challenge_id}/decline (POST Decline a 3DS transaction)

- SCA_CHALLENGE Webhook: New property added:

challenge_id

Changed

- Cards API: All transaction-related endpoints have been assigned the tag "Card transactions." The tag "Cards Smart Agent" was replaced.

- Block and Unblock a card endpoints: Changed the response schema type from an

arrayto anobject.

2023-08-21

Changed

- Seizures guide: Added clarification on when to send seizure notifications to active vs. inactive customers.

2023-08-16

Added

- Account Closure guide: Added new section about the new field

failure_reasonand its possible values. - Account Closure guide: Added new validation for account closure requests for SDDs. Solaris will postpone the processing of an ACR in case an SDD was pulled from the account in the last 56 days. This validation is only relevant for Decoupled and Credit Cards products.

- Account Closure webhooks: Added new webhook event

ACCOUNT_CLOSURE_REQUEST_UPDATEto notify of certain status transitions for account closure requests (ACR).

Changed

- ACCOUNTCLOSUREREQUEST: Updated webhook payload to include the new field

failure_reason. - Account Closure Requests endpoints. Updated response payload to include the new field

failure_reason.

2023-08-14

Added

- B2B Fronting loans: New status added

cdd_pendingfor B2B Fronting and B2B Fronting Factoring. The application status will transition tocdd_pendingwhen Solaris triggers the CDD checks for the business. If any of the CDD checks fails, the application will be rejected. - [B2B Fronting loans]: Customer Due Diligence is now mandatory for B2B Fronting and Fronting Factoring. The customer must pass the CDD checks before they can be onboarded. Note: Enhanced Due Diligence is not relevant for this use case. Only green or red CDD statuses are possible.

- Person identifications API: Added missing enum values for

account_verification_errorfield.

Changed

- Booking types: The booking type

Target2CreditTransferhas changed toTARGET2_CREDIT_TRANSFER.

2023-08-07

Changed

- Business Fronting Loans guide: Reviewed the guide and made language changes to make the guide more concise and added new diagrams.

- POST Create a person endpoint: Added two new enums (

K 66.22&L 68.2) for thenace_codefield. - SCA_CHALLENGE webhook: Removed the sentence

Only EUR is currently supported.Different currencies are supported for this use case. - SEPACREDITTRANSACTION_DECLINED Webhook: Updated the webhook payload to indicate that only the value

declinedwill be returned as astatusfor this webhook.

2023-08-02

Added

- SMS service: New endpoint added to send generic SMS messages to your customers. This endpoint can be used in the context of any product or business use case that require sending informational texts to customers.

Changed

- AML update process: Updated the data points to confirm. The fields

emailandcontact_addresshave been removed from all countries and customer segements. Added the fields in theaddressobject for accuracy in all countries and customer segments.

2023-07-27

Added

- Consumer Overdrafts guide: Added a section about how to request termination for consumer overdrafts.

Changed

- Business Credit Cards guide: Reviewed the guide and made language changes to make the guide more concise.

2023-07-25

Added

- [Consumer Overdrafts]: Added a new endpoint to terminate a consumer overdraft.

Changed

- POST Create a bank statement for an account: Fixed a bug in the response payload and updated the fields in the

account_informationobject. - POST Create a business identification: Fixed a bug in the response payload. The field

legal_identification_missing_informationhas been modified toarray of stringsinstead ofstring.

2023-07-24

Added

- Bankident guide: Added a list of the allowed banks that can be used in the Bankident KYC flow.

- POST Block a card endpoint: Added two new fields to the response:

creation_dateandline_2.

2023-07-20

Added

- Fee collection API: New fee type added:

ChargeFXCardTransaction

2023-07-11

Added

- 3DS guide: Added a new section explaining all the available 3DS testing endpoints.

- Credit Cards overview: Added a new section about the interest accrual logic for revolving credit cards.

- Customer Due Diligence guide: Added a new section around simulating a CDD hit using the Questions & Answers feature.

- Questions and Answers guide: Added a new section around testing the Q&A feature.

Changed

- Device Monitoring guide: Added a hint about how using the suspicious device activity ID will also trigger the Questions and Answers feature.

- Encrypted PIN change guide: Modified the guide to include steps for both the regular device signing method and the change request method. Deferred to the API docs for full explanations.

- Fee collection API reference: Added the list of fee booking types to the API reference and removed the corresponding appendix from the fee collection guide.

- Freelancer Credit Cards guide: Reviewed the guide and made language changes to make the guide more concise.

Deleted

- Strong Customer Authentication guide: Removed "card PIN change" from the list of use cases that require 2FA.

2023-07-07

Added

- [Cards creation & servicing]: Added two new fields:

key_idandencrypted_pinto the endpoint Create a card endpoint, along with instructions on how to set an encrypted PIN for the card using this endpoint. - Consumer Overdrafts: Add a new application status for consumer overdraft applications

deleted. Solaris deletes failed applications in compliance with GDPR. - [Encrypted PIN change service]: Added a new endpoint to retrieve latest public key: GET Retrieve latest public key.

Changed

- [Encrypted PIN change service]: This endpoint is deprecated and replaced by a new version: GET Retrieve latest public key.

- Video identification via IDnow: The status

pending_successfulis deprecated. An IDnow status can only transition frompendingto eithersuccessfulorfailed.

2023-06-29

Added

- Cards transaction simulator API: New endpoint: POST Simulate an expired card authorization

-

- New property added to credit card application resource:

statement_with_details - New enum values added to credit card application

upcoming_billing_cycleandcurrent_billing_cycleproperties: - WEEKLY

- BIWEEKLY

- MONTHLY

- QUARTERLY

- New property added to credit card application resource:

-

- Added a table of fee types and definitions to the API reference.

- Added new enum values to the

typeproperty of a fee transaction: - ChargeATM

- ChargeATMForeignCurrency

- ChargeCard

- ChargeVirtualCard

- ChargeReissuePhysicalCard

- ChargeAdditionalPhysicalCard

- ChargeAdditionalVirtualCard

- ChargeReissueVirtualCard

- ChargeCardMaintenance

- BoosterPackage

- ChargeAccountMaintenance

- ChargeTopUpCard

- ChargeAdditionalAccountMaintenance

- ChargeSharedAccount

- ChargeAuthorizedUser

- ChargeGamblingTransactionPartner

- ChargeSEPAInstantOutgoing

- ChargeSEPAInstantIncoming

- ChargeManualSepaTransferPartner

- ChargeIncomingSwift

- ChargeGamblingOrCashEquivalent

- Person identifications API: New endpoint: (Manual KYC only) POST Mark identification as failed

Changed

- POST Create SEPA Direct Debit Return: Corrected the maximum valuta date age to

56days (from53).

2023-06-28

Added

- POST Create a card endpoint: New field added

line_2. - TARGET2 Incoming Transfers guide: New guide added on TARGET2 Incoming transfers feature, which enables incoming high-value cross-border transfers.

Changed

- Decoupled Cards for Consumers guide: Reviewed the guide and made language changes to make the guide more concise, including adding process diagrams.

2023-06-23

Added

- Legal & Compliance screens guide: Added a note that partners must record the timestamp of the customer's confirmation of their FATCA relevance in the attribute

fatca_crs_confirmed_atin the person resource. - ACCOUNT_CLOSURE_REQUEST Webhook: Added missing fields to webhook payload.

Changed

- Cards creation & servicing: Fixed the list of supported characters for cards creation to include

.. - GET Retrieve a single account opening request: Changed

statusenum value ofFAILEDtoREJECTED.

2023-06-21

Added

- GET Index Top-Ups for a person's account: Added new filter:

filter[instruction_id] - GET List fee transactions for an account: Added new property to fee schema and new filtering option:

solaris_initiated - REFERENCE_ACCOUNT_CREATED webhook: Added property

account_idto webhook payload. - REFERENCE_ACCOUNT_INSTANT_PAYOUT_DECLINED webhook: Added property

decline_reason_detailsto webhook payload.

Changed

- GET Check Bankident eligibility: Changed

failure_reasonproperty to an array offailure_reasons. - Credit cards guide: Updated "Credit card usage" section to indicate that customers can only make outgoing transfers to their reference accounts via reference account payouts, not SCTs.

2023-06-09

Changed

- BKYC required documents: Updated the section with the required documents for more legal forms. This section currently only covers legal forms for Germany.

- POST Create a business: Added more values for the

legal_formfield and explained the mapping in the legal form per country section in the onboarding requirements guide.

2023-06-08

Changed

- 3DS guide: Condensed both the SMS OTP and the in-app method sections into one standard flow.

2023-06-06

note

We've updated the site to include a CRR logo to highlight that this site contains the API documentation for Solaris’ banking license products (CRR) and to distinguish it from the e-money license products (EMI) documentation website.

Added

-

[Cards API reference]: New endpoints are added Testing allowlists for tokenized cards, which are used to create cards allowlists for production testing on GooglePay or ApplePay:

Changed

-

[Cards API reference]: Changed the structure of the section by adding additional subsections:

- Card creation & servicing: Includes different endpoints related to creating and servicing cards.

- Cards tokenization: Includes the following services: Push Provisioning, Testing allowlists, and Visa tokens servicing.

- Credit cards: Includes different endpoints related to creating and servicing credit cards.

- Reservation endpoints: Updated the reservation endpoints to include both versions. The old version

2022-06-01will be deprecated soon. Partners must switch to the new version. Please note that you've to set the api-version header to the version you want (e.g.,2022-07-18). If no version is specified in the header, the old version is returned. - [Strong Customer Authentication guide]: Changed the section when is SCA required to reflect the new regulations specifying that customers must login using SCA if more than 180 days instead of 90 days have elapsed since the last time the customer had been authenticated using SCA.

- PATCH Set limit for credit card account: Fixed the endpoint's response to a single

objectinstead of anarray.

2023-06-02

Added

- [Consumer overdrafts]: Added missing

409response to POST Create a consumer overdraft application.

2023-05-25

Added

-

Fee collection guide: Added new sections:

2023-05-24

Added

- POST Create person: Added a note regarding the

mobile_numberfield. This field is only used to pass the number to IDnow for the videoident KYC flow. Otherwise, you must use the mobile number endpoints to create and manage mobile numbers for your customers.

Changed

- Consumer Credit Cards guide: Revised the contents of the guide to be more concise and precise. (No substantive change to the contents)

- POST Request authorization for a person's mobile number: Fixed the response code to this endpoint from

200to201. - POST Confirm a customer's mobile number: Fixed the response code to this endpoint from

200to201.

2023-05-19

Added

- Document collection for freelancers: Added the requirements for collecting proof of profession for freelancers in Italy and Spain.

- POST Create consumer overdraft application: Added a new error

409for duplicate records. - POST Create person: Added a note regarding the use of real personal data when testing on Sandbox.

- Overdrafts API reference: New overdraft status added:

terminatedin all overdrafts products (Business, Consumer, and Freelancer). - Bankident guide: Added section about IBAN validation prior to creating the identification session.

- Added new endpoint: POST Validate IBAN

Changed

- Account Closure Request webhook event: Added a missing field

payout_allowedto the webhook payload. - Videoident (IDnow) guide: Revised the contents of the guide to be more concise and precise. (No substantive change to the contents)

2023-05-12

Added

-

Consumer Credit Line API reference:

-

Added new endpoints about credit line renewals (only relevant for France):

- Added a new tag Credit Line Servicing for servicing endpoints, which are relevant for both consumer and freelancer credit lines.

-

- Consumer & Freelancer Splitpay guides: Added a section about credit line account statements.

-

Consumer Splitpay guide: Added the following to the guide:

- Added a section about credit lines renewals relevant for customers in France only.

- Added new sequence diagram and application status diagram.

- Freelancer Splitpay guide: Added new sequence diagram and application status diagram.

- Webhook events: Added new webhook event CREDIT_LINE_APPLICATION, which is tiggered whenever the status of a consumer credit line application changes.

Changed

- BKYC guide: Revised the contents of the guide to be more concise and precise. (No substantive change to the contents)

- CREDIT_LINE webhook event: Updated the webhook payload.

- Consumer Splitpay guide: Reviewed the guide and made language changes to make the guide more concise.

- Freelancer Splitpay guide: Reviewed the guide and made language changes to make the guide more concise.

- LOAN webhook event: Updated the webhook payload.

Deleted

- Webhook events: Removed the webhook event

REPAYMENT_PLANfrom the API reference and loan guides. Webhook event is deprecated. -

Consumer Credit Lines API reference: Removed all endpoints related to terminating and blocking credit lines from the public API reference. Termination and blocking is handled internally by Solaris:

- PATCH Terminate a credit line

- POST Block a credit line

- GET Retrieve a block

- GET Index all blocks

- DELETE Remove a block

2023-04-28

Changed

- (Bankident only) Check identification eligibility endpoint: Corrected the response payload for this endpoint.

- Credit Cards guides and API reference: Added new enum values for the credit card application

statusfield, and added two new application status flows:(one for B2B customers and one for B2C and freelancer customers). - Customer Due Diligence guide: Added a note that for the CDD flow for B2B customers to highlight that only the property

screening_progressis relevant for thebusinessresource andpersonresource(s) for all natural persons associated with the business.

2023-04-26

Added

- Device Binding guide: Added definitions of restricted and unrestricted key pairs and updated flow diagram to include

unrestrictedin the first step. - Legal and Compliance screens: Added the FATCA hard and soft screening criteria to the guide.

- Reference Account Payouts API reference: New field added

instant_payment_railto enable sending Instant SCTs to reference accounts. - SEPA Instant guide: Added a note about how to send Instant SCTs to reference accounts.

Changed

- INSTANT_SEPA_CREDIT_TRANSFER_EXECUTED Webhook event: Updated the

statusfield to indicate that the only possible value to be returned isCLEARED. - INSTANT_SEPA_CREDIT_TRANSFER_FAILED Webhook event: Updated the

statusfield to indicate that the only possible value to be returned isFAILED.

Deleted

- Removed the webhook event PERSON_CREDIT_RECORD from all lending guides and API reference section.

2023-04-25

Added

-

New webhook events added:

Changed

- Consumer Loan guide: Updated the whole guide with language and stylistic changes to make the information more concise and reflect the updated API reference, and added new diagrams.

2023-04-21

Changed

-

Card transactions simulation endpoints:

- Moved POST /v1/cards/{cardid}/test3ds_authentication (POST Create test 3DS transaction) from "Cards servicing" to "Card transactions simulation."

- Renamed POST /v1/cards/{card_id}/simulator/transactions/authorization from "Execute a test transaction" to "Simulate an authorization."

- Renamed POST /v1/cards/{card_id}/simulator/transactions/settle from "Execute a test transaction standalone settlement" to "Simulate an unauthorized settlement."

- Renamed POST /v1/cards/{cardid}/simulator/transactions/{transactionkey}settle/ from "Execute a test transaction settlement" to "Simulate the settlement of an authorization."

Deleted

- POST /v1/changerequests/{changerequest_id}/authorize (Request authorization for a change request): Removed

device_bindingas a possible enum value fordelivery_method.

2023-04-19

Added

-

Card transactions simulation API: Added new endpoints:

- POST /v1/cards/{card_id}/simulator/transactions/settle: Execute a test transaction standalone settlement

- POST /v1/cards/{cardid}/simulator/transactions/{transactionkey}/settle: Execute a test transaction settlement

- Cards servicing guide: Added a new annex about how the card's status changes after a customer reports a card as lost/stolen based on the

loss_reasonprovided.

Changed

-

Card transactions simulation API: The URL for the "Execute a test authorization" endpoint has changed.

- Old URL:

/v1/cards/{card_id}/simulator/transactions - New URL:

/v1/cards/{card_id}/simulator/transactions/authorize

- Old URL:

- POST /v1/cards/{cardid}/virtualrequests (POST Create a secure view for card details): Changed the key requirement for the signature from restricted to unrestricted.

- Card spending controls guide: Updated the introduction with more use cases for the feature, and added sample UIs to the guide.

2023-04-13

Added

- API standards: Added a note that Solaris only accepts UTF-8 Latin characters for fields related to customer data.

- POST /v1/cards/{id}/loststolenincidents: Added a note to highlight that the card

statusfield can only have certain values (ACTIVE,INACTIVE,BLOCKED, orBLOCKED_BY_SOLARIS) before calling this endpoint. - POST /v1/changerequests/{changerequest_id}/authorize: Added the value

device_bindingto thedelivery_methodenum.

Changed

- Person onboarding guide: Updated the whole guide with language and stylistic changes to make the information more concise, added a new dynamic onboarding overview diagram, made new reference links to the onboarding requirements guide for country-specific requirements.

- POST /v1/accounts/{accountid}/transferrequests/{transferrequestid}/executions: Corrected the possible values for the field

status. -

POST /v1/cards/{card_id}/simulator/transactions:

- Changed

transaction_idproperty totransaction_key. - Removed the

WITHDRAWALvalue for thetypeenum and replaced it withCASH_ATM. - Changed the length of the

acquirer_idfield from 11 to 6 digits.

- Changed

2023-04-11

Added

- Consumer Loan API reference: Added a new endpoint and a new field to skip the account snapshot.

Changed

- Consumer Loan API reference: The fields

mortgageandrentare now deprecated from the Create a consumer loan application endpoint.

2023-04-05

Added

- Device Monitoring guide: Added Seon React native wrapper to the list of SDKs.

Changed

-

- Added a hint about what information you must communicate to customers when informing them of account closure.

- Updated the list of criteria that must be checked prior to automated account closure.

- Clarified the legal vs. technical account closure date and when each occurs.

- Added a hint about initiating ACRs with reasons other than

CUSTOMER_WISHor for accounts with compliance blocks.

- Business onboarding guide: Updated the whole guide with language and stylistic changes to make the information more concise, added a new dynamic onboarding overview diagram, made new reference links to the onboarding requirements guide for country-specific requirements.

- Customer Due Diligence guide: Updated the EDD process flow to include the new questions & answers feature, which replaces the support ticket flow.

- Onboarding requirements guide: Removed product availability diagram.

2023-03-28

Added

- Onboarding requirements guide: Added a new guide in the Get Started section that gives an overview of the different onboarding requirements according to the product, customer type, and branch.

Changed

- Legal and Compliance Screens: Moved under the new onboarding requirements guide.

- Webhooks documentation: Corrected the name of

DELEGATE_SCA_CHALLENGEtoDELEGATE_SCA_CANCEL.

2023-03-23

Added

- Webhooks guide: Added a new section that describes all headers that are included in a webhook notification.

Changed

- Documentation for all webhook events has been migrated to OpenAPI format. Now all webhook event payloads are fully documented in the same way as the API specs, with descriptions for each header and property in a webhook notification.

2023-03-07

Added

- Card spending controls: Added new scope:

PARTNER_CARDHOLDERS - Postbox: Added new

document_typevalue:SINGLE_FEE_STATEMENT - Terms and Conditions consent log: Added new request/response property:

document_name

Changed

- PATCH Update a person: Updated the list of request parameters to indicate the properties that can actually be updated by this call.

2023-03-06

Added

- New guide: Account Opening

- New guide: Questions and Answers

- Device Monitoring guide: Added an important hint that you may not create user activity without first collecting the customer's consent to device monitoring.

- Fourthline guide: Added a new step that customers must sign the terms & conditions of Namirial before starting the QES flow.

- Legal & compliance screens guide: Added a new screen for the self-declaration of politically exposed persons. Only relevant for customers opening an account in France, Italy, and Spain.

- Onboarding guides: Added information about Tax identification numbers (TIN) in France, such as syntax rules and examples. Additionally, collecting tax IDs is optional for customers whose tax residency is in France.

- B2B onboarding guides (Credit cards, Digital Banking, BKYC, Trade Finance, Business Fronting Factoring, Business Fronting): Added instructions about how to handle business legal representatives that are also legal entities.

Changed

- Legal & compliance screens guide Updated the legal text for the terms and conditions screen.

- Legal & compliance screens guide Updated the legal text for the customer information screen.

Deleted

-

Removed deprecated endpoints:

/v1/cards/{id}/limits/card_present/v1/cards/{id}/limits/card_not_present

2023-02-22

Changed

- Credit Cards guides: Information about creating the SDD manadate has changed. The first 6 digits of the SDD mandate number must be a partner-specific string agreed upon by you and Solaris during the implementation phase.

- SEPA Instant Credit Transfers guide: Product flow diagram has been corrected to show that only the

CLEAREDstatus triggers the webhook notification.

2023-02-14

Added

-

Card creation & servicing guide: Added new transaction declined reasons:

LIST_CONTROLSPENDING_LIMIT

- Cards visa tokenization API: Added new filter:

visa_token_number

2023-02-08

Changed

-

Brokerage guide:

- Clarified the differences between the GET Simulate a Trade and GET Retrieve a Trade Price endpoints.

- Updated the list of all values to reflect the current state of the API (e.g., removed all instances of

min_amountandmax_amountand replaced them withfrom_asset_min_amountandfrom_asset_max_amount). - Clarified that a value of

nullforfrom_asset_max_amountindicates that there is no limit for trading thefrom_asset.

2023-02-06

Added

-

Cards API: New API endpoints:

- Credit Cards API: Added new field

repayment_type_switch_available_dateto the credit card application resource. -

Webhooks: Added new field

account_idto the following webhooks:

Deleted

- [SEPA Instant Credit Transfer API]: Removed the

GET /v1/accounts/{account_id}/transactions/sepa_instant_credit_transfers/{id}endpoint.

2023-01-30

Added

-

Business API: Added new values to the

legal_formenum property:PRIVATE_PERSONADORAMTKDORSTIFTUNGENSECOKGAGCOKGAT_AMTAT_KORAT_STIAT_GMBHFR_AEFR_EILU_SECALU_ASBLLU_FONLU_SPNL_VERENNL_STICHTPL_SAPL_SPZOOPL_SEPL_SKAPL_SPKPL_SPJPL_SELF_EMPLOYEDPL_OTHERCH_DE_AGCH_FR_SACH_IT_SACH_DE_GMBHCH_FR_SARLCH_IT_SAGLCH_SECH_DE_KOMAGCH_FR_SCACH_IT_SACACH_DE_KGCH_FR_SCMCH_IT_SACCH_DE_KIGCH_FR_SNCCH_IT_SNCCH_DE_EGCH_FR_SSCH_IT_SSCH_SELF_EMPLOYEDCH_SOLE_PROPRIETORSHIPTR_ADI_SIRTR_ASTR_LSTR_KOM_STITR_KOLL_STITR_SELF_EMPLOYEDTR_SOLE_PROPRIETORSHIPRO_SARO_SRLRO_SCARO_SCSRO_SNCRO_SELF_EMPLOYEDRO_SOLE_PROPRIETORSHIPRS_ADRS_DOORS_KDRS_ODRS_SELF_EMPLOYEDRS_SOLE_PROPRIETORSHIPHR_DDHR_DOOHR_JDOOHR_KDHR_JTDHR_SELF_EMPLOYEDHR_SOLE_PROPRIETORSHIPHR_ORTABG_ADBG_OODBG_KDABG_KDBG_SDBG_SELF_EMPLOYEDBG_SOLE_PROPRIETORSHIPSI_DDSI_DOOSI_KDDSI_KDSI_DNOSI_SELF_EMPLOYEDSI_SOLE_PROPRIETORSHIPHU_NYRTHU_KFTHU_BTHU_KKTHU_SOLE_PROPRIETORSHIPHU_SELF_EMPLOYEDHU_ORTA

Deleted

- Business API: Removed hint from POST Create a beneficial owner for a business about mandatory tax information collection.

2023-01-27

Added

- Postbox guide New document type

FEE_SUMMARY_STATEMENTis now available via Postbox to customers in Spain. - API standards Added a link to Master Card merchant category codes reference manual.

Changed

- Person onboarding guide The text for the account opening button has changed to include that it's subject to a charge.

- Business onboarding guide Added a note that

voting_shareis not mandatory in case of fictitious beneficial owners. - Cards API Updated enum list for possible card types with a note that we don't list all possible values for the card

typeproperty, but only an indicative list. - 3DS guide Corrected the order of the authentication steps.

2023-01-24

Changed

-

[Cards API] Solaris now offers two endpoints for Encrypted PIN Change:

- POST Change PIN with Change Request: Changes the card's PIN without a Change Request. Note that this endpoint includes Device Monitoring.

- POST Change PIN: Changes the card's PIN using a Change Request.

-

[Solaris Digital Assets - Brokerage API] Changed some properties for the TradingPrice resource:

precisionwas renamed toprice_precisionminamount was changed tofrom_asset_min_amount- Added corresponding

from_asset_max_amountproperty

2023-01-20

Added

- [Legal & Compliance screens guide] Added screenshots of sample screens.

- [Overdrafts API] New property added to GET Overdraft endpoints (all customer types):

interest_accrued - [Solaris Digital Assets API] New attribute for

TradingPairresources:max_amount -

[Solaris Digital Assets API] New endpoint added: GET Simulate a Trade for a given Trading Pair

Changed

-

[Legal & Compliance screens guide]

- Noted that you must also collect consent for Solaris' Terms & Conditions for all business legal representatives and authorized persons during signup.

- Clarified that T&C consent during onboarding must be passed in the person or business resource, not the Terms and Conditions API.

- [Solaris Digital Assets API] The GET Get the trade price of a Trading

Pair

endpoint no longer returns

traded_to_amountortraded_from_amountproperties. - [Solaris Digital Assets - Brokerage guide] Partners are now requested to use GET Simulate a Trade for a given Trading Pair for displaying the price of a Trade to an end user prior to conducting a Trade.

2023-01-13

Added

- [API reference - Errors guide] Added a new section about API error handling and how to request support from Solaris.

- [Strong Customer Authentication] Added more information about SCA login requirements.

- [Webhooks guide] Added a new recommendation about generating a signature hash for content verification.

Changed

- [Account management guide] Changed booking type

CANCELLATION_CARD_TRANSACTIONtoCancellationCardTransaction. - [Mobile Number Management guide] Clarified that a verified mobile number is mandatory for all customers in all branches, not just Italy & Spain.

2023-01-11

Added

- [Business fronting API] Added property

factoring_feein the POST Create business fronting loan or fronting factoring application endpoint. - [Business fronting API] Added value

VAT_TRANSFERfor thetagproperty in the POST Trigger a partial loan payout for a business fronting factoring endpoint. - [Card spending controls] Added information about the PARTNER_CARDS_DEFAULT scope for card spending limit controls.

- [Instant Card Top-Ups] New webhook event added: ACQUIRER_TOPUP_PAYMENT_FAILED.

- [Instant Card Top-Ups API] New endpoint added: POST Cancel a Top-Up

- [Overdrafts] New webhook event added: OVERDRAFT_LIMIT_CHANGE.

Changed

-

[Instant Card Top-Ups] Clarified some points in the guide:

- The

ACQUIRER_TOPUP_DECLINEDwebhook event will only trigger when Solaris declines a Top-Up transaction. If a customer's payment attempt fails, then theACQUIRER_TOPUP_PAYMENT_FAILEDwebhook event will trigger. - The guide has been updated with instructions on how to cancel a Top-Up.

- Clarified the definitions of each Top-Up status value in the appendix to reflect the above changes.

- The

- [Overdrafts] Updated the guides to indicate that Overdrafts monitoring is optional.

- [SEPA Instant Credit Transfer] Clarified that the GET Check the reachability of an IBAN endpoint only checks the reachability of the recipient's bank, not of the individual IBAN.

Deleted

- [SEPA transfers API] Removed all

GETendpoints for SEPA Direct Debit returns. - [Transactions API] Removed all Partner remittances endpoints.

2023-01-10

Added

-

New guide and API reference for SEPA Instant Credit Transfers are added:

- Customer Due Diligence guide CDD process is now also mandatory for B2B customers. Added the B2B flow for CDD monitoring and validation, as well as process diagrams.

- Video identification guide. Added preconditions that must be met for video identification integration.

- Account Closure guide and Splitpay guides. Added a note about Splitpay termination in case of account closure to the account closure guide and the Splitpay guides.

- Card spending controls guide. Added a note about the internal scope

PARTNER_CARDS_DEFAULT, which can only be set by Solaris.

2022-12-21

Added

-

[SDA Custody - Account management] Added an example for creating an Account of type

TOKEN.Deleted

- [Device monitoring] Removed POST Create a person from the list of actions that require device monitoring. Removed the

device_dataproperty from the API docs for this endpoint.

2022-12-20

Changed

- The company legal name was changed from "Solarisbank AG" to "Solaris SE."

2022-12-16

Added

- [Business onboarding] Important: Collecting tax information from all natural persons associated with a business (e.g., legal representatives, beneficial owners, and any authorized person) is now mandatory in all branches and for any banking product, including Digital Banking, Cards and Lending products, such as Fronting and Fronting Factoring.

- [Business onboarding] Important: Collecting valid addresses from all natural persons associated with a business (e.g., legal representatives, beneficial owners, and any authorized person) is now mandatory in all branches and for any banking product, including Digital Banking, Cards and Lending products, such as Fronting and Fronting Factoring.

- [Cards API] Added new endpoint for testing card transactions: POST /v1/cards/{card_id}/simulator_transactions

- [Webhooks] New cards webhook added: DELEGATE_SCA_CHALLENGE. This webhook notifies you when a customer declines the authentication process for a 3DS transaction.

Changed

- [Loans API] Corrected the attribute type of installment

numbertostringin GET Retrieve a loan schedule - [Webhooks] Corrected the example payload for the CARD_AUTHORIZATION_DECLINE_V2 webhook.

2022-12-14

Added

- [AML update guide] Added a table of required data points to confirm for each branch (i.e., not just DE).

- [Cards push provisioning] Added

400response example to all cards push provisioning API endpoints. - [Clearing transactions] Added

initiator_referenceproperty to all clearing transaction API endpoints. -

[Device monitoring]

- Updated the device monitoring guide with information about how a customer may withdraw their GDPR cookie consent.

- Added a new API endpoint: PATCH Update user consent for device monitoring.

Deleted

- POST Create a card: Removed

card_configuration_idproperty.

2022-12-05

Added

- Authentication guides Created a new section under Guides to group all authentication guides together and explain how they are related.

- Moved Device binding and Strong Customer Authentication guides to the new authentication section.

- [Cards creation and servicing] Added new appendix describing card status flows.

Changed

-

- Added a note to notify customers immediately about account closures initiated by Solaris.

2022-11-25

Added

-

New consumer overdraft API endpoints:

Deleted

- [Cards creation and servicing] Removed

DUPLICATE_TRASACTION_TYPEfrom the list of transaction decline reasons (V2).

2022-11-18

Added

- [Account management guide] Added SepaInstantCreditTransfer to the list of booking types.

- [Fourthline guide] Added Proof of Address requirement.

- [Fourthline guide] Added missing upload a QES document step.

- [Business/Consumer/Freelancer Overdrafts guides] Added a note about overdraft information included on statements of account & bank statements.

Changed

- [Cards servicing guide] Updated the transaction decline reasons table (V2) with the correct values.

- [Encrypted PIN change guide] Clarified the need to use the restricted key when requesting a PIN change.

- [SEPA Direct Debit guide] Marked the SEPA Direct Debit for Business/Freelancers product as legacy.

- PATCH /persons/{person_id}/identifications/{id}/authorize: Removed "Bankident only" from the title and removed note about the IdentHub SDK.

- PATCH /persons/{person_id}/identifications/{id}/confirm: Removed "Bankident only" from the title and removed note about the IdentHub SDK.