Bankident API integration

This section includes step-by-step instructions on integrating Bankident as a standalone solution with the standard API integration.

note

If you want to use IDnow as the KYC method in another integration flow of any of Solaris' products (e.g., there's an existing person resource and verified mobile number for the customer), you can jump to Step 3.

Webhooks

Solaris recommends subscribing to the following webhook events to better automate your processes. For detailed instructions on implementing Solaris webhooks, check the webhooks documentation.

Integration flow

The following sequence diagram gives an overview of the integration flow for Bankident stand-alone solution:

Integration overview

Integrate Solaris' Bankident by completing the following steps:

User registration

- Collect the mandatory customer data and consent to the legal and regulatory requirements in your sign-up flow, and create a person resource for your customer by completing Step 1.

- Create and verify the customer's mobile number by completing Step 2.

Identification creation & account verification

- Collect the customer's consent on Swisscom's terms and conditions as a UTC timestamp and create an identification resource for the customer using POST Create identification

- Trigger the identification process using PATCH Request identification.

- Redirect the customer to the URL returned in the response body of the previous call.

- The customer completes the account verification process by entering their IBAN and logging in to their bank account to authorize the cent payment.

Qualified Electronic Signature (QES)

- After successful payment transfer, display the relevant contract(s) to the customer in your UI before the signing process starts.

- Trigger the QES process by calling PATCH Start QES process. This action sends an SMS OTP to the customer's verified mobile number.

- The customer must enter the OTP on your UI.

- Confirm the QES process using PATCH Confirm QES, and add the token in the request body.

- The signed documents must be made available to the customer either as a direct download or sent via email or other methods.

You can find detailed descriptions of these steps and their related endpoints in the following sections.

Step 1: Collect customer data and create person resource

In this step, you must collect the mandatory data points from the customer in your sign-up flow, including all the timestamps of the customer's consent to the legal and compliance screens. Afterward, pass all the data points to Solaris by creating a person resource.

API reference

For a complete list of endpoints, properties, and examples related to the person resource, visit the following links:

Related webhook events

Important points about data collection

- Please consider the special requirements for data collection highlighted in the onboarding requirements guide.

- You must submit the information exactly as it appears in official documents.

- When testing the process on Sandbox, please ensure that each person you create has unique values for

first_name,last_name,birth_city, andbirth_date. If you create over 1000 identical person resources, the API will return a400error. - Don't use any personal data when testing this endpoint on Sandbox.

POST Create person

This endpoint creates a person resource for your customer. You must collect the mandatory data points from your customer in the sign-up flow and pass them to Solaris in the request body of this endpoint.

salutationfirst_name(including all middle names as printed on the ID document)last_name(including all name parts as printed on the ID document)birth_datenationalityISO 3166-1 alpha-2 codesaddress(Street, Number, City, Post Code, Country, State)mobile_numberdata_terms_signed_at(UTC timestamp)terms_conditions_signed_at(UTC timestamp)

Request URL

POST /v1/personsResponse

The API returns a person object with a unique ID for the person (i.e., the

person_id). You will need this id to append the person resource with

additional information in the remaining steps of this guide.

Click here to view the full API reference

PATCH Update person

This endpoint updates one or more properties on a person resource. You can only update the following properties using this endpoint:

titlesalutationaddress(line_1,line_2,postal_code,city,state,country)contact_address(line_1,line_2,postal_code,city,state,country)employment_statusjob_titleemailtax_information(tax_assessment,marital_status)fatca_relevantfatca_crs_confirmed_atbusiness_purposeindustryindustry_keyown_economic_interest_signed_ataml_confirmed_on(only with today or tomorrow's date)expected_monthly_revenue_centsvat_numberwebsite_social_mediabusiness_trading_namenace_codebusiness_address_line_1business_address_line_2business_postal_codebusiness_citybusiness_countryannual_income_rangedata_terms_signed_atbranchbirth_provincebirth_post_codesocioprofessional_categorypurpose_of_account_openingmain_income_sourcework_countrywork_provinceself_declared_as_pepinternational_operativity_expectationregistration_number

attention

- Fields not mentioned in this list can only be updated via Customer Support.

-

Only for B2C customer: If a customer changes their

employment_statustoFREELANCERorSELF_EMPLOYED, please note that you must apply one of the following options to the same request to avoid getting an error:- Collect the

nace_codefrom the customer, or - Set the fields

industryandindustry_keytonull.

- Collect the

- Solaris recommends collecting the

nace_codefrom the customer for the sake of data quality.

Request URL

PATCH /v1/persons/{id}Click here to view the full API reference

note

Please note that Solaris calls SCHUFA at this step to verify the customer's identity and legitimation data.

Step 2: Create and verify mobile number

In this step, you must collect the customer's mobile number in your sign-up flow and then create a mobile number resource and verify it by sending an SMS OTP to the customer's mobile number. Afterward, the customer enters the received OTP to verify their number.

Mobile number resource

Creating and verifying a mobile number for your customer is a crucial step in the customer onboarding process. With a verified mobile number, customers can use SMS OTPs to complete two-factor authentication (2FA) challenges, which is a requirement for Strong Customer Authentication (SCA).

info

- In some use cases (e.g., stand-alone integrations, the mobile number is verified during the identification process).

API reference

Visit the following link to find all the endpoints related to the mobile number resource, including related properties and examples.

Related webhook events

Testing static values

To test the following endpoints on Sandbox, you can use the following static values:

- Mobile number:

+15550101 - SMS OTP:

212212

POST Create mobile number

Collect the customer's mobile number and pass it to Solaris using the following API call, and include the customer's person_id in the request URL.

Request example:

POST /v1/persons/{person_id}/mobile_number

{

"number": "+15550101"

}Response example:

The API returns a mobile_number resource with a unique id and attaches it to the person resource.

{

"id": "91e4d939d781b8eb30d1ee86809761c2cmno",

"number": "+15550101",

"verified": false

}Click here to view the full API reference.

POST Authorize mobile number

Use the following endpoint to verify the ownership of the provided mobile phone number. The endpoint initiates a one-time-password (OTP) flow: Solaris sends a six-digit OTP to the customer's number, and then they must enter it in your UI.

Request example:

POST /v1/persons/{person_id}/mobile_number/authorize

{

"number": "+15550101"

}Response example:

{

"id": "91e4d939d781b8eb30d1ee86809761c2cmno",

"number": "+15550101",

"verified": false

}Click here to view the full API reference..

POST Confirm mobile number

Use this endpoint to submit the SMS OTP the customer received on their mobile number to finalize the mobile number authorization process. You must add the customer's number and token (i.e., the SMS OTP) in the request body. Afterward, the mobile number will be verified and can be used in the context of Strong Customer Authentication (SCA).

Request example:

POST /v1/persons/{person_id}/mobile_number/confirm

{

"number": "+15550101",

"token": "212212"

}Response example:

{

"id": "91e4d939d781b8eb30d1ee86809761c2cmno",

"number": "+15550101",

"verified": true

}Click here to view the full API reference.

Mobile number management

For more information about how to manage mobile numbers, check the related guide.

Step 3: Create person identification

In this step, you must do the following:

- Prompt your customer to enter their IBAN on your frontend. It will be used for the SCHUFA check to validate the IBAN and verify that the person associated with this IBAN has been previously identified with the bank.

- Collect the customer's consent to Swisscom's terms and conditions as a UTC timestamp.

- Initiate the identification process by creating an identification resource for your customer and pass the information in the request body of the following endpoint.

(Optional) POST Check identification eligibility

As an initial verification step, you can check whether the relevant customer is eligible for the given identification method or not based on their data, such as nationality, place of residence, or identification document.

This endpoint validates whether the person specified in the request URL is eligible to complete a given identification method. You must add the identification method for which you want to check the customer's eligibility in the request body.

Request example

POST /v1/persons/{person_id}/identification_eligibility_checks

{

"method": "bank"

}Response example

The API call returns a response as to whether the person is eligible for identifying with a particular method or not. In case of failure, a reason is provided in the field failure_reason.

{

"method": "bank",

"eligible": true,

"failure_reason": "null"

}Click here to view the full API reference

(Optional) POST Validate IBAN

Solaris offers an endpoint for validating the IBAN supplied by the customer. If the IBAN is valid, then the API will return information about the account's associated bank.

Request URL

POST /v1/iban_lookupsClick here to view the full API reference.

POST Create identification

This endpoint creates an identification resource for the person specified in the request URL. You must add the following properties in the request body:

method: The identification method, usebank.iban: The customer's IBAN to be used for the account validation.terms_and_conditions_signed_at: The UTC timestamp of the customer's consent to Swisscom's terms and conditions.

note

This endpoint does not send a request to the identification provider to start the identification process.

Terms and conditions legal text

You can use the following legal texts for the Swisscom terms and conditions checkbox.

English

I read and understood the General Terms and Conditions of Swisscom.

German

Ich habe die Allgemeinen Geschäftsbedingungen der Swisscom gelesen und verstanden.

Request example

// POST /v1/persons/{person_id}/identifications

{

"method": "bank",

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z"

}Response example

The API call returns an identification object with a unique id, the identification_id, and the identification status, set initially to created.

For a list of possible values for the field status and their descriptions, check the appendix.

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": null,

"status": "created",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": null,

"confirmation_expires_at": null

}Click here to view the full API reference.

attention

- This call automatically triggers a SCHUFA check, in which we validate if the provided IBAN belongs to the customer and if the customer has been identified before for this IBAN.

- If SCHUFA finds no record of this IBAN and the customer, the status of the identification will be

failedand the rejection reasons will be returned in the fieldfailure_reason. Check the appendix for possible values for this field and their descriptions. - If the SCHUFA check fails, the customer can either try identifying again with a different IBAN or offer them a different KYC method.

Step 4: Validate bank account and issue payment

In this step, you must do the following:

- Trigger the identification process by calling the PATCH Request an identification method. The call returns a URL to which you must redirect your customer to complete the bank account verification steps.

- First, the customer enters their IBAN. If the IBAN validation is successful, the customer is prompted to log in to their bank account using their online banking credentials. This action initiates an account snapshot and triggers a cent transfer.

- The customer must then authorize a cent transaction using their bank's 2FA method (e.g., SMS OTP or App push notification).

PATCH Request identification

This endpoint requests Solaris to begin the process for the person identification specified in the URL. The identification status will change to pending after calling this endpoint.

Request URL

PATCH /v1/persons/{person_id}/identifications/{id}/requestResponse example

This call automatically triggers an account snapshot process with FinTechSystems. The API call returns the identification object with the status pending and the url (FTS iframe) to which you must redirect your customer to log in to their bank account.

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "pending",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": null,

"confirmation_expires_at": null,

"estimated_waiting_time": null

}Click here to view the full API reference.

You must redirect your customer to the URL returned in the previous call to complete the account verification steps. This includes:

- Entering their IBAN for the identity check. If the IBAN validation is successful:

- Logging in to their bank account to authorize the cent payment using their bank's 2FA methods. This could be entering an SMS OTP or using biometrics to authorize a push notification in the bank's app.

GET Retrieve identification account snapshot

Returns an account snapshot that was added to a person identification. The status of the account snapshot record for the given person will trigger the IDENTIFICATION webhook as soon as it is available. This means that the cent payment has been initiated.

The Bankident status should then change to authorization_required, and the customer must authorize the payment using their bank's 2FA method.

Request URL

GET /v1/persons/{person_id}/identifications/{id}/account_snapshotResponse example

{

"iban": "DE92370601930002130041",

"id": "d42a2dfcf32c4550bd1e1fe373bb953bsnap",

"location": "https://docs.solarisbank.com/",

"provider": "FINREACH",

"status": "available",

"status_description": "string",

"wizard_session_key": "null"

}Click here to view the full API reference

Step 5: Sign contracts using Qualified Electronic Signature (QES)

After a successful payment transfer, the customer can proceed with signing the relevant contracts.

note

The contracts could be a simple KYC report or contracts related to the product the customer is being identified for, such as a loan contract.

PATCH Start QES process

This method begins the authorization process for a person identification via BankIdent. When called, it triggers a Swisscom iframe and prompts Swisscom to send an SMS OTP to the customer. Call this endpoint when the identification reaches the authorization_required status.

note

The OTP expires after five minutes. During this five-minute window, any newly requested OTPs will not be valid. Therefore, Solaris recommends waiting five minutes before reissuing an OTP.

Request example

PATCH /v1/persons/{person_id}/identifications/{id}/authorizeResponse example

The customer must enter the OTP within the validity period. The status of the identification changes to confirmation_required until you confirm the QES.

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "confirmation_required",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678",

"estimated_waiting_time": null

}Click here to view the full API reference

PATCH Confirm QES

After the customer enters the SMS OTP, use this endpoint to confirm the QES. Call this endpoint when the person identification reaches the status confirmation_required.

Request example

PATCH /v1/persons/{person_id}/identifications/{id}/confirm

{

"token": "1234"

}Response example

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "confirmed",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678"

}Click here to view the full API reference

GET Retrieve person identification

This endpoint returns a completed person identification (i.e., the person identification process was successful). If you use the include_documents filter, this method will also return the documents submitted by the customer during the identification process.

You can use this endpoint to check the identification status and details. Additionally, subscribe to the webhook event IDENTIFICATION to receive status updates on the identification process.

Request example

GET /v1/persons/{person_id}/identifications/{id}Response example

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "successful",

"completed_at": "2022-08-11T08:29:43.000Z",

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"address": null,

"documents": [

{

"id": "a6585ea2b053a69fb705a0eb963084cfcdoc",

"name": "a7a57dadfcc83117b5c3b72f4113be25cidt_prepared_for_signing_kyc_report.pdf",

"content_type": "application/pdf",

"document_type": "QES_DOCUMENT",

"size": 88139,

"customer_accessible": false,

"created_at": "2022-08-11T08:25:11.000Z"

},

{

"id": "4d1aa91e091e375e30e94de4ab1cf0f4cdoc",

"name": "SIGNED_a7a57dadfcc83117b5c3b72f4113be25cidt_prepared_for_signing_kyc_report.pdf",

"content_type": "application/pdf",

"document_type": "SIGNED_QES_DOCUMENT",

"size": 88139,

"customer_accessible": false,

"created_at": "2022-08-11T08:29:43.000Z"

}

],

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678"

}Click here to view the full API reference.

GET Index person bank identification attempts

This method returns all the bank identification attempts for the person specified in the request URL.

Request URL

GET /v1/persons/{person_id}/bank_identification_attemptsResponse example

[

{

"id": "17a7389adaf83145770d8e6c00a398dfiatm",

"person_id": "e2bbc86268e9a4667861b73f31dba03bcper",

"identification_id": "efa83e0d8a9f33be3aeb5b5122d759adcidt",

"successful": true,

"failure_reason": "null",

"iban": "DE11110101010100000020",

"created_at": "2021-06-25T09:44:25.000Z"

}

]Click here to view the full API reference.

After the customer successfully completes the video identification process, you can download the signed documents using our document-related endpoints here.

What's next?

Congratulations! You've successfully integrated Solaris' Bankident solution.

Check the following appendix section for additional information on enums, testing data, and Bankident FAQs.

For an overview of other KYC methods, check the customer KYC products overview page.

Useful resources

Check the following links for additional related guides and API reference documentation:

Appendix I: Enums

Bankident status

The following table includes the possible values for Bankident status and their descriptions.

| Status | Description |

|---|---|

created |

The identification resource has been created for a customer. |

pending |

The identification process has been triggered and the URL for the account snapshot has been sent. |

authorization_required |

The payment initiation step is successful and you must now initiate the QES process when the identification reaches this status by calling PATCH Start e-signing process. |

confirmation_required |

The customer received an SMS OTP for the QES on their verified mobile number and they must enter it on your UI. After the customer enters the OTP, you must call PATCH Confirm QES e-signing process to complete the QES process. |

successful |

The identification process was successful. |

failed |

The identification process failed. This could be for different reasons. Check the appendix for possible scenarios. |

expired |

The identification process expired. This could be due to a delay in authorizing the payment or entering the OTP for the QES process. |

Appendix II: Testing data

Test scenarios

Your solution must consider the following edge cases for Bankident:

- The user data was not found.

- The user's IBAN could not be matched to the provided name.

- The account provided is a JOINT account (i.e., shared account).

- An authorized person on the account (i.e., someone who does not own the account) attempts to identify.

- Timeout of 10 minutes between payment initiation and finalization of QES.

You can test edge cases with the following mocked IBANs:

| IBAN | Mocked behavior | Error code |

|---|---|---|

| DE11110101010100000020 | Success from service provider & Swisscom | |

| DE43110101010000000010 | Success—Access by authorized holder | |

| DE22110101010100000016 | User data not found in service provider DB | HTTP 412, MATCH_FOR_PERSON_DATA_NOT_FOUND |

| DE33110101010100000012 | User without QBit | HTTP 412, PREVIOUS_IDENT_NOT_FOUND |

| DE44110101010100000008 | Account check failed on Schufa | HTTP 412, PERSON_ACCOUNT_MATCH_NOT_FOUND |

| DE55110101010100000004 | Account was JOINT | HTTP 409, expectation_mismatch |

| DE66110101010100000000 | Account snapshot failed | HTTP 409, expectation_mismatch |

| DE77110101010100000093 | Success from service provider and unsuccessful in Swisscom | |

| DE77110101010100000093 | Every subsequent Authorize QES SMS TAN will invalidate the previous TAN |

Happy path test scenario

Complete the following steps to simulate a successful identification workflow with Bankident on Sandbox.

1. Create a person

Create a person resource using the following endpoint and add the following fields in the request body.

Request

POST /v1/persons

{

"salutation": "MR",

"first_name": "Leander",

"last_name": "Zierfisch",

"address": {

"line_1": "BERLINER STR. 45",

"line_2": "",

"postal_code": "14169",

"city": "Berlin",

"country": "DE"

},

"birth_date": "1978-07-15",

"birth_city": "Aachen",

"birth_country": "DE",

"nationality": "DE",

"email": "person@example.com",

"employment_status": "EMPLOYED",

"fatca_relevant": "false",

"fatca_crs_confirmed_at": "2019-01-01T00:00:00Z",

"terms_conditions_signed_at": "2019-01-01T00:00:00Z",

"own_economic_interest_signed_at": "2019-01-01T00:00:00Z"

}2. Create and verify a mobile number

You can follow the same steps mentioned in the guide and use the static values.

3. Create an identification

Create an identification resource and specify the identification method as bank in the request body of the following endpoint. Add the person_id returned from the previous API call to the request URL. Additionally, include the iban for a successful identification

Request example

POST /v1/persons/{person_id}/identifications

{

"method": "bank",

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z"

}4. Trigger the identification

To trigger the identification flow, call the following endpoint and add the person_id and the identification id returned from the previous API calls to the request URL.

Request example

PATCH /v1/persons/{person_id}/identifications/{id}/requestResponse

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "pending",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": null,

"confirmation_expires_at": null,

"estimated_waiting_time": null

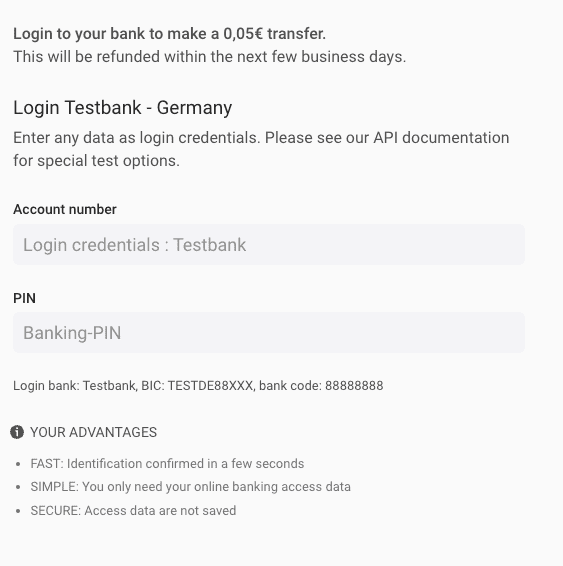

}5. Complete the payment transfer step

Go to the URL returned in the previous call and enter any number for the account number and the banking PIN and click NEXT. This screen simulates a login screen, in which the customer must log into their online banking and authorize a 5-cent transfer to validate the account ownership.

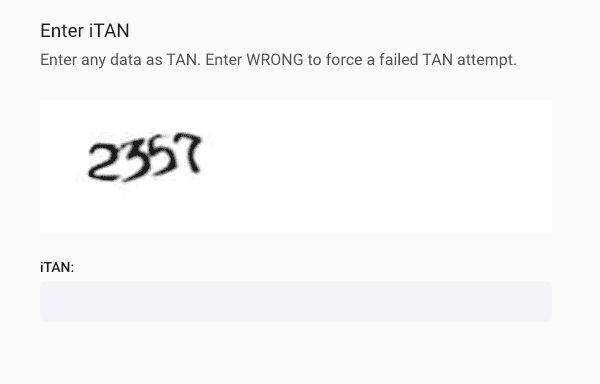

After clicking NEXT, another screen will pop up and you have to enter any TAN number to authorize the transaction. This screen simulates the screen in which the customer must enter the SMS OTP they received on their verified mobile number to authorize the transaction.

6. Complete the QES step

After successful payment transfer, complete the QES process by doing the following steps:

- Call PATCH Start e-signing process. Add the

person_idand identificationidin the request URL.

Request

PATCH /v1/persons/{person_id}/identifications/{id}/authorizeResponse

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "confirmation_required",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678",

"estimated_waiting_time": null

}- Call PATCH Confirm e-signing process. Add the

person_idand identificationidin the request URL.

Request

PATCH /v1/persons/{person_id}/identifications/{id}/confirmResponse

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "confirmed",

"completed_at": null,

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678"

}- Afterward, call GET Retrieve a person identification and the response should include a

successfulstatus and the signed documents with their IDs.

Request

GET /v1/persons/{person_id}/identifications/{id}Response

{

"id": "a7a57dadfcc83117b5c3b72f4113be25cidt",

"reference": null,

"url": "https://fts-payment-initiation-wizard.solaris-sandbox.de/index.html?wizard_session_key=bfo5r16AMLlt6ZEX9Oh3JUWIkTelorupBwzIlJRR&interface_id=da05",

"status": "successful",

"completed_at": "2022-08-11T08:29:43.000Z",

"method": "bank",

"proof_of_address_type": null,

"proof_of_address_issued_at": null,

"address": null,

"documents": [

{

"id": "a6585ea2b053a69fb705a0eb963084cfcdoc",

"name": "a7a57dadfcc83117b5c3b72f4113be25cidt_prepared_for_signing_kyc_report.pdf",

"content_type": "application/pdf",

"document_type": "QES_DOCUMENT",

"size": 88139,

"customer_accessible": false,

"created_at": "2022-08-11T08:25:11.000Z"

},

{

"id": "4d1aa91e091e375e30e94de4ab1cf0f4cdoc",

"name": "SIGNED_a7a57dadfcc83117b5c3b72f4113be25cidt_prepared_for_signing_kyc_report.pdf",

"content_type": "application/pdf",

"document_type": "SIGNED_QES_DOCUMENT",

"size": 88139,

"customer_accessible": false,

"created_at": "2022-08-11T08:29:43.000Z"

}

],

"iban": "DE11110101010100000020",

"terms_and_conditions_signed_at": "2020-07-07T11:36:29.000Z",

"authorization_expires_at": "2022-08-11T08:38:21.000Z",

"confirmation_expires_at": "2022-08-11T08:37:23.000Z",

"current_reference_token": "1234-5678"

}Appendix III: Bankident rejection reasons and error codes

The following table includes the possible failure reasons for Bankident. These failure reasons are also relevant for Bankident+ method.

| HTTP status | Error code | Description | UI user error message | Actions |

|---|---|---|---|---|

| 412 | IBAN_USAGE_LIMIT_EXCEEDED |

The provided IBAN has been blacklisted due to reaching the limit of failed attempts for this IBAN. | DE: Sie haben das Limit an Versuchen erreicht. Bitte fahren sie mit der Video-Identifizierung fort. EN: You have reached the limit of attempts. Please continue with the video identification. |

Potential Fraud attempt, onboarding should stop. Show generic message to the customer |

| 412 | MOBILE_NUMBER_NOT_VERIFIED |

The customer does not have a verified mobile number. | Verify the mobile number and retry the call. | |

| 412 | IDENTIFICATION_ATTEMPTS_EXCEEDED |

The mobile number or the combination of first_name and last_name reached the limit of failed attempts to create an identification. |

DE: Diese Identifikations-methode steht nicht zur Verfügung. Bitte fahren sie mit der Video-Identifizierung fort. EN: This identification method is not available. Please continue with video identification. |

Potential Fraud attempt, onboarding should stop. Show generic message to user |

| 422 | ALREADY_IDENTIFIED_SUCCESSFULLY |

The customer has been successfully identified. | DE: Sie haben sich bereits erfolgreich identifizert. EN: You have already successfully identified yourself. |

Stop onboarding. Ask customer to use their existing account. |

| 412 | MATCH_FOR_PERSON_DATA_NOT_FOUND |

The customer's record could not be found in SCHUFA. Usually happens to customers who, for example, recently moved to Germany. | DE: Diese Identifikations-methode steht nicht zur Verfügung. Bitte fahren sie mit der Video-Identifizierung fort. EN: This identification method is not available. Please continue with video identification. |

No action needed |

| 412 | PERSON_ACCOUNT_MATCH_NOT_FOUND |

We could not establish a connection between the customer and the provided IBAN. The customer can try again with a different IBAN. | DE: Für diese IBAN steht diese Identifikationsmethode nicht zur Verfügung. Bitte versuchen Sie es mit einer anderen IBAN oder fahren Sie mit Video-Identifizierung fort. EN: This identification method is not available for this IBAN. Please try another IBAN or continue with video identification. |

No action needed |

| 412 | PREVIOUS_IDENT_NOT_FOUND |

The customer did not meet the identification preconditions. | DE: Diese Identifikations-methode steht nicht zur Verfügung. Bitte fahren sie mit der Video-Identifizierung fort. EN: This identification method is not available. Please continue with video identification. |

The customer cannot be onboarded with this identification method. |

| 412 | PERSON_MISSING_REQUIRED_DATA |

The customer is missing some of the required data. Der Person fehlen notwendige Daten |

DE: Ein Fehler ist aufgetreten. Bitte kontaktieren Sie den Support. EN: An error has occurred. Please contact Solaris support. |

Ask the customer to enter the missing data and retry the call. |

| 412 | DEPENDENCY_ERROR |

External provider service failure | DE: Ein Fehler ist aufgetreten. Bitte kontaktieren Sie den Support. EN: An error has occurred. Please contact Solaris support. |

Contact Solaris. |

| 412 | INVALID_MODEL |

Something went wrong, tech bug. | DE: Ein Fehler ist aufgetreten. Bitte kontaktieren Sie den Support. EN: An error has occurred. Please contact the support. |

Check the request JSON body and retry the call. Contact Solaris if the issue is not solved. |

| 412 | INTERNAL_REQUEST_ERROR |

Something went wrong, tech bug | DE: Ein Fehler ist aufgetreten. Bitte kontaktieren Sie den Support. EN: An error has occurred. Please contact Solaris support. |

Contact Solaris. |

| 412 | GENERIC_ERROR | Something went wrong, tech bug. | DE: Ein Fehler ist aufgetreten. Bitte kontaktieren Sie den Support. EN: An error has occurred. Please contact Solaris support. |

Contact Solaris. |

| 412 | ACCESS_BY_ATHORIZED_HOLDER |

The customer is not the account holder of the account, but an authorized person on the account. This is not allowed for fraud protection reasons. | DE: Sie sind nicht Kontoinhaber. Bitte nutzen sie eine andere IBAN oder fahren Sie mit der Video-Identifizierung fort. EN: You are not the account holder. Please use another IBAN or continue with the video identification. |

The customer can try again with a bank account of which he is the account holder. |

| 412 | EXPIRED |

The identification has expired (happens after 30 days). | DE: Ihr Identifizierungsprozess ist abgelaufen. Bitte versuchen Sie es erneut. EN: Your Identification attempt has expired. Please Try again. |

A new identification must be created for the customer to restart the process. |

| 412 | ACCOUNT_SNAPSHOT_FAILED |

The payment initiation (5 cent transfer) process failed. This process step is done by an external provider and failure could have various reasons. | DE: Die Bankanmeldung oder Überweisung ist fehlgeschlagen. Bitte versuchen Sie es erneut. EN: The bank login or transfer has failed. Please try again. |

The customer can try again process with a different IBAN. |

| 412 | JOINT_ACCOUNT |

The provided account for the identification is a joint account. This is not allowed for fraud protection reasons. | DE: Gemeinschaftskonten sind nicht unterstützt. Bitte nutzen sie eine andere IBAN oder fahren Sie mit der Video-Identifizierung fort. EN: Joint accounts are not supported. Please use a different IBAN or continue with video identification. |

The account that was used for the identification is a joint account, please make sure to connect an account solely owned by you. |

| 412 | ACCOUNT_SNAPSHOT_EXPIRED |

The payment initiation expired. After requesting the identification (i.e. starting the payment initiation), the user has 10 minutes to complete the 5 cent transfer. Afterward, the payment initiation is expired by our service provider. | DE: Die Anmeldesitzung der Bank ist abgelaufen. Bitte versuchen Sie es erneut. EN: The bank login session has expired. Please try again. |

It looks like you did not confirm the 5-cent transfer within the dedicated 10 minutes time frame. Please try to onboard again |

Appendix IV: Bankident FAQs

The following are common questions and answers related to the integration process of Bankident solution. If you have other questions or use cases not mentioned in this guide, contact your Partner Manager for support.

How many attempts with different IBANs can one "person" submit leading to receiving generic error messages on the identification creation?

20 attempts.

Does the user have to provide a DE IBAN or can it also be an IBAN with a different country code?

Currently, only German IBANs are supported for Bankident. If your customer doesn't have a German IBAN, check the other available identification methods here.

Can the user get their mobile phone number identified using every country code? Or does it have to be +49 for germany? Do you have a list of country codes allowed?

All country codes are supported except for Iran and North Korea.

Can the user have an address outside of Germany? If yes, which countries are allowed?

Yes, the user can have any kind of address. However, the probability that SCHUFA will correctly identify the person will decrease, since SCHUFA checks depend on the person's registered address.

How long is an SMS token valid?

The SMS authorization of the QES process is valid for 10 minutes.

Can a successful identification be "reused" by different companies?

There's no technical restrictions on reusing an identification. However, GDPR measures related to data cleanup must be defined.

Is there any timeout set for finishing the bank connection widget?

There is a 10-minute timeout.