Business Overdrafts

This guide explains how to integrate Solaris' Overdraft product for business customers (B2B) into your solution.

Introduction

Product specifications

Business overdrafts are currently only available for customers with a current bank account with Solaris. For more information about overdrafts and how they work, check the Overview page.

System prerequisites

Before integrating Solaris' Business overdrafts for your customers, the customers must have been onboarded and have a checking bank account with Solaris. For step-by-step instructions on business onboarding for Digital Banking and Cards, check the Business onboarding guide.

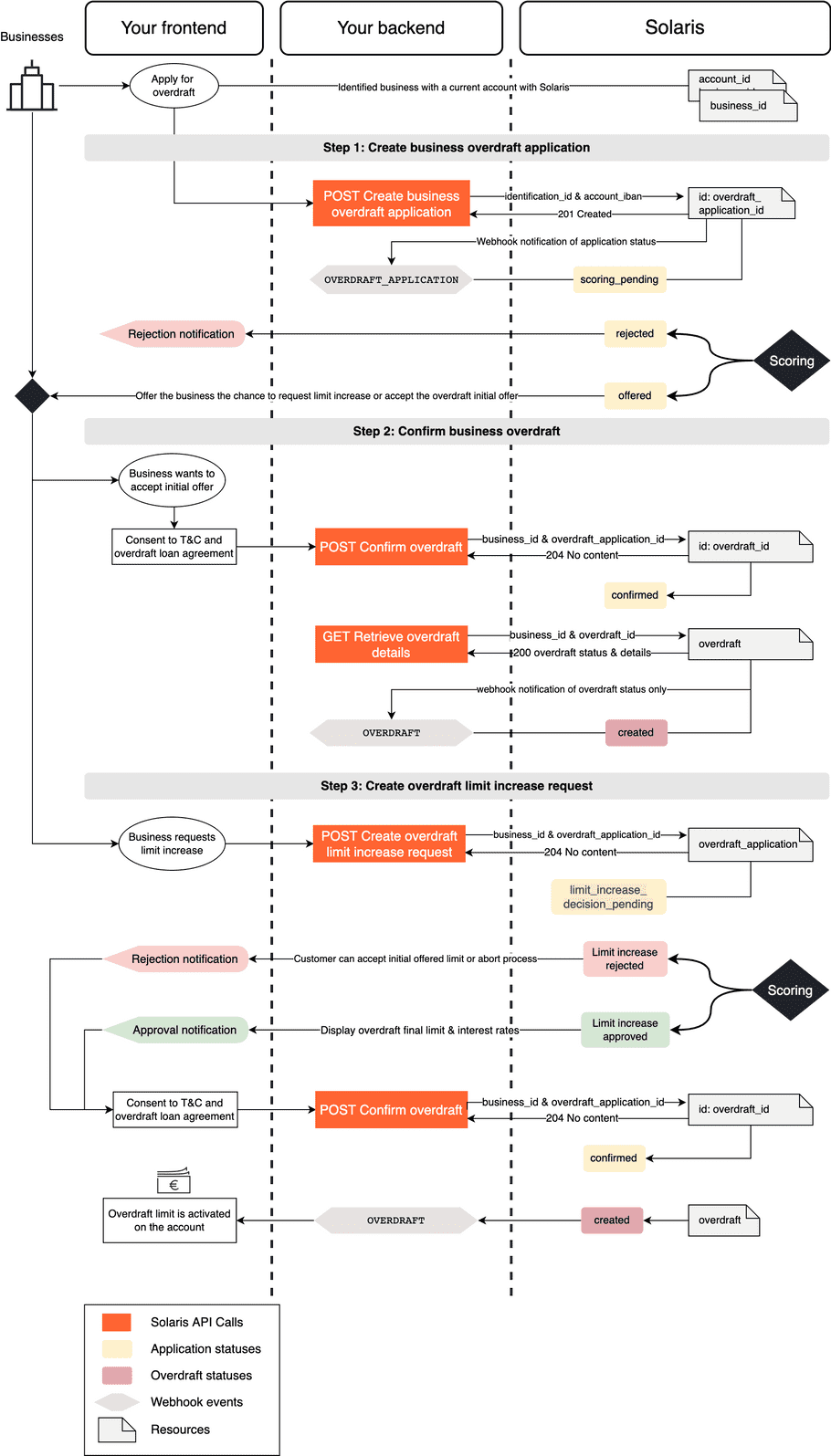

Integration overview

The following sequence diagram gives an overview of the integration flow for Business Overdrafts:

Integrate Solaris' Business Overdrafts by completing the following steps:

| Stage | Step | Description |

|---|---|---|

| Overdraft application | Step 1 | Collect the required information from your customers on your frontend and create a business overdraft application. |

| Confirm overdraft | Step 2 | If Solaris approves the application, and the customer does not wish to request a limit increase, complete this step to confirm the overdraft with the initial limit. If Solaris rejects the application, abort the onboarding process. |

| Limit increase request | Step 3 | If Solaris approves the application, and the customer wishes to request a limit increase, complete this step to request a limit increase. |

| Limit increase request | Step 2 | If Solaris approves the limit increase request, complete this step to confirm the overdraft with the new limit. If Solaris rejects the request, either abort the onboarding process or confirm the overdraft with the initial limit. |

| Overdraft servicing | Step 4 | Integrate all endpoints related to overdrafts servicing. |

You can find detailed descriptions of these steps and their related endpoints in the following sections.

Webhooks

Solaris recommends subscribing to the following webhook events to better automate your processes. For detailed instructions on implementing Solaris webhooks, check the webhooks documentation.

Step 1: Create business overdraft application

In this step, you must collect the mandatory information from the business in your sign-up flow and pass this information to Solaris by creating a business overdraft application for your customer.

The overdraft application includes all the required information about the business and links to other mandatory resources, such as identification_id and account_iban, which the credit scorer uses to initiate a series of credit checks.

POST Create business overdraft application

This endpoint creates a business overdraft application for the given business with the business_id specified in the path parameter.

Mandatory properties:

Add the following mandatory properties in the request body:

identification_idaccount_iban

Request URL

POST /v1/businesses/{business_id}/overdraft_applicationsResponse example

The API call returns an object with a unique id for the business overdraft application, including the application status, set initially to scoring_pending, and the remaining attributes, which will be populated during the application lifecycle.

Click here to view the full API reference

GET Retrieve business overdraft application

This endpoint returns the current status and details of an existing business overdraft application. For a list of possible values of the application status and their descriptions, check the Appendix.

Additionally, subscribe to the webhook event OVERDRAFT_APPLICATION to receive status updates on the overdraft application.

Request URL

GET /v1/businesses/{business_id}/overdraft_applications/{overdraft_application_id}Click here to view the full API reference

POST Cancel business overdraft application

This endpoint cancels an existing business overdraft application. After calling this endpoint, the overdraft application status changes to canceled.

Request URL

POST /v1/businesses/{busiess_id}/overdraft_applications/{overdraft_application_id}/cancelClick here to view the full API reference

Scoring results

After Solaris receives the business overdraft application, it either rejects or approves the application.

If Solaris approves the business overdraft application, you can offer the business two options in your flow:

- Option 1: Accept the initial overdraft limit right away. In this case, implement Step 2: Confirm business overdraft.

- Option 2: Request a limit increase. In this case, implement Step 3: Request overdraft limit increase and then Step 2: Confirm business overdraft.

important

Once a business confirms an offered overdraft limit, it's not possible to request a limit increase afterward.

Step 2: Confirm business overdraft

After Solaris approves the overdraft application, the application status changes to offered. In this case, you can offer the business the chance to request a limit increase or accept the initial_overdraft_limit. If the business decides to accept the initial overdraft limit, complete the following steps:

- Inform the business of the approval on your frontend, and show the

initial_overdraft_limitand applicable interest rates. - Collect and record the business's consent to Solaris' terms and conditions and the overdraft loan agreement as a UTC timestamp.

- Confirm the overdraft by calling the following endpoint.

POST Confirm business overdraft

Call this endpoint to confirm the overdraft. Afterward, the overdraft application status changes to confirmed.

Request URL

POST /v1/businesses/{business_id}/overdraft_applications/{overdraft_application_id}/limit_increase/confirmClick here to view the full API reference

GET Retrieve business overdraft

This endpoint returns all the details of an existing business overdraft assigned to the business with the given business_id in the path parameter.

Additionally, subscribe to the webhook event OVERDRAFT to receive status updates about the overdraft.

note

Please note that the webhook sends status updates only. You must call the GET method for the full overdraft details.

Request URL

GET /v1/businesses/{business_id}/overdrafts/{overdraft_id}Response example

The API call returns the overdraft object with the unique id and includes the overdraft's details, such as limit and overdraft_rate. The status returned in the response refers to the overdraft's status. For a list of possible values of overdraft statuses and their descriptions, check the Appendix.

Click here to view the full API reference

Step 3: Request overdraft limit increase

After Solaris approves the overdraft application, the application status changes to offered. In this case, you can offer the business the chance to request a limit increase or accept the initial_overdraft_limit. If the business decides to request a limit increase, complete the following steps:

- Create a limit increase request by calling the following endpoint.

- If Solaris approves the limit increase request, complete Step 2: Confirm business overdraft.

-

If Solaris rejects the limit increase request, the business can either:

- Abort the process. To cancel the application, call POST Cancel business overdraft application.

- Accept the

initial_overdraft_limit. To confirm the overdraft, complete Step 2: Confirm business overdraft.

POST Increase business overdraft limit

This endpoint requests a limit increase for an existing business overdraft application—the overdraft application status changes to limit_increase_decision_pending after calling this endpoint.

Request URL

POST /v1/businesses/{business_id}/overdraft_applications/{overdraft_application_id}/limit_increaseClick here to view the full API reference

Scoring results

An overdraft limit increase request is subject to an additional scoring step. Solaris assesses and scores the business overdraft application again and issues a verdict with either acceptance or rejection.

Acceptance

If Solaris approves the limit increase request, the status changes again to offered. Afterward, confirm the overdraft with the final_overdraft_limit by completing Step 2: Confirm business overdraft.

Additional information

Solaris could also request additional information or documents to be submitted before making a decision. In this case, the application status will change to information_required.

Rejection

If Solaris rejects the limit increase request, the business can either:

- Abort the process. To cancel the application, call POST Cancel business overdraft application

- Accept the

initial_overdraft_limit. To confirm the overdraft, complete Step 2: Confirm business overdraft.

POST Cancel a business overdraft application

This endpoint cancels an existing business overdraft application. After calling this endpoint, the application status will change to canceled.

attention

This action cannot be revoked. A new application must be created if the customer wants resume the process.

Request URL

POST /v1/businesses/{business_id}/overdraft_applications/{overdraft_application_id}/cancelClick here to view the full API reference

Step 4: Servicing overdrafts

This section includes important information about handling and monitoring active overdrafts.

Overdrafts limits and interest

Overdraft limits cannot be exceeded for any SEPA transfers, direct debits, payments, or withdrawals, except for charged interest fees by Solaris. Any payment exceeding the limit will be rejected.

Overdrafts monitoring (Optional)

For specific overdraft-related events, you can monitor the account, implement specific event triggers, and provide pre-defined messages to the user.

For example, you can implement event triggers and send out reminders to customers in the following events:

- The customer has used 90% of the overdraft limit or only 100€ remaining in the limit.

- Three days before the interest payment is due to customers with a used overdraft at the end of each quarter.

Overdrafts booking types

Using the overdraft limit reflects on the customer's account statement for interest charges. The following booking types are distinct to overdraft interest charges:

InterestOverdraft: The interest accrued in relation to the used portion of the overdraft limit.InterestOverdraftExceeded: The interest accrued in relation to exceeding the overdraft limit (Note that the limit itself cannot be exceeded for regular transactions except for interest charges).

Account closure for accounts with an overdraft

In case of Account Closure Requests (ACR) for accounts with an attached overdraft, you must first terminate the overdraft before initiating the ACR process.

Overdrafts in statements of account & bank statements

Each statement of account and bank statement generated for customers with overdrafts will contain the following overdraft information for the statement period:

overdraft_facility: Overdraft facility that has been granted to the customer.overdraft_rate: The increased interest rate applied when going below the granted overdraft facility.interest_accrual_rate: The daily rate at which interest is accrued on the used amount of an overdraft.interest_accrued: The interest accrued, in Euro cents.

See the Account management guide for more information.

Overdrafts termination

To terminate an overdraft, you must send an overdraft termination request to Solaris either by creating a JIRA ticket or sending an email to support@solarisbank.de. Solaris will process the request internally and remove the overdraft limit from the customer's account.

attention

Terminating an overdraft CANNOT be reversed. However, a customer can apply for a new overdraft.

What's next?

Congratulations! You've successfully integrated Solaris' Business Overdraft solution.

Check the following appendices section for additional information on enums and testing data.

For an overview of Solaris' lending products, check the lending products overview page.

Useful resources

Check the following links for additional related guides and API reference documentation.

Appendix I: Enums

Business overdraft application status

These are the possible values for the field status in the business overdraft application resource.

| Status | Description |

|---|---|

scoring_pending |

Solaris successfully received the overdraft application and is assessing and scoring the application. |

offered |

Solaris approved the overdraft application, either in the initial scoring or accepted the limit increase request. |

rejected |

Solaris rejected the overdraft application, either in the initial scoring or the limit increase request is rejected. |

confirmed |

The overdraft application is confirmed and created on the customer's account. |

limit_increase_decision_pending |

A limit increase request is created on the overdraft application, and Solaris is re-assessing the application. |

information_required |

Solaris requires additional information from the customer. |

Business overdraft status

These are the possible values for the field status, which indicates the status of an overdraft that is already offered.

| Status | Description |

|---|---|

created |

The overdraft is created. |

conditions_pending |

Interest conditions are pending and yet to be set by Solaris. |

limit_pending |

Overdraft limit is pending and yet to be set by Solaris. |

attached |

Overdraft is attached to the customer's account. |

terminated |

Overdraft is terminated. |