A Restricted Account is a limited-capability current account designed primarily for settlement transactions within a defined scope (e.g., a Crypto wallet or Investment account).

Unlike a full Digital Banking account, a restricted account operates in a "closed loop" with a linked Reference Account.

- Closed Loop: Funds can typically only enter from or exit to a linked Reference Account (an external bank account held in the customer's name).

- Auto-Linking: When a customer sends an SCT (SEPA Credit Transfer) to their Restricted Account for the first time, Solaris validates the sender's name. If it matches, that external account is automatically saved as a Reference Account.

- Limits: Default pay-in limits are 20,000 EUR per transaction and 200,000 EUR per month.

- Excluded Features: Restricted accounts cannot support:

Before starting the customer onboarding process, you must implement the following requirements:

Before starting, ensure your environment is configured for the Digital Banking product scope.

- Authentication: Retrieve your client credentials and set up your OAuth flow.

- Webhooks: Configure your endpoint to receive event notifications (e.g., incoming transfers, status changes).

View the Technical Setup Guide

You must integrate specific consent screens into your signup flow before initiating the API onboarding process.

Required Screens:

- Terms & Conditions: Collect explicit consent to Solaris T&Cs.

- Customer Information: verify personal details.

- Economic Interest: Confirm the customer is acting on their own behalf.

- Tax Information: Collect Tax ID (required for Germany).

- FATCA/CRS: Determine US tax liability.

- PEP Declaration: Self-declaration for Politically Exposed Persons (Required for FR, IT, ES).

Data Storage: For every consent screen, you must capture a UTC timestamp (e.g., 2023-10-27T10:00:00Z). These timestamps are mandatory fields when creating the person resource.

| Consent Type | API Field (Person Resource) |

|---|---|

| Terms & Conditions | terms_conditions_signed_at |

| Data Processing | data_terms_signed_at |

| Economic Interest | own_economic_interest_signed_at |

| FATCA/CRS | fatca_crs_confirmed_at |

Subscribe to these events to track account status and transactions:

Solaris recommends subscribing to the following webhook events to automate your wallet and compliance processes.

Track the lifecycle of the account and incoming/outgoing funds.

ACCOUNT_BLOCKACCOUNT_CLOSURE_REQUESTACCOUNT_CLOSUREBOOKING- Critical. A transaction (incoming or outgoing) was booked.INCOMING_REJECTED_TRANSACTIONREFERENCE_ACCOUNT_CREATED

Monitor changes to retail customer data.

PERSON_CHANGEDPERSON_DELETEDPERSON_TAX_IDENTIFICATION_CHANGEDPERSON_MOBILE_NUMBER_CREATEDPERSON_MOBILE_NUMBER_DELETEDIDENTIFICATION

Monitor changes to business entities and their representatives.

BUSINESS_CHANGEDBUSINESS_DELETEDBUSINESS_IDENTIFICATIONBUSINESS_TAX_IDENTIFICATION_CHANGEDBENEFICIAL_OWNERLEGAL_REPRESENTATIVE

Notifications when authorities seize funds or update seizure status.

Person Seizures:

Business Seizures:

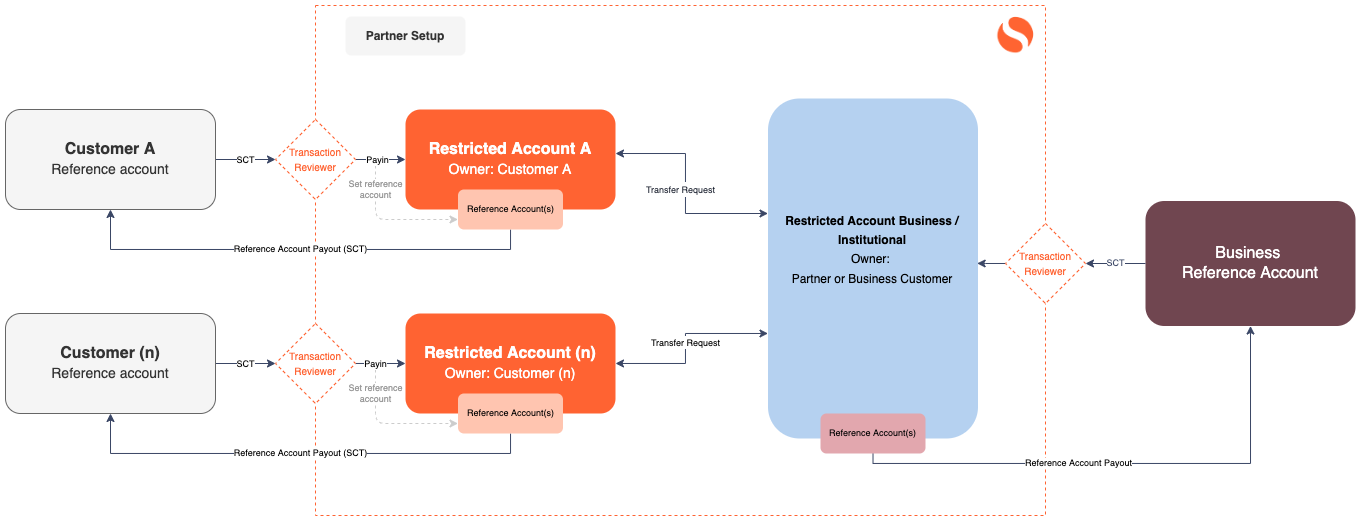

Restricted accounts rely on a specific flow of funds between the Customer, the Partner (you), and the Reference Account.

Follow the standard Account Opening process, but use the specific ledger types for restricted accounts.

- Identify: Complete the Onboarding process.

- Create: Submit an Account Opening Request (AOR) with the specific parameters below.

When calling the AOR endpoint, you must use one of the following account_type values (instead of CHECKING_...):

- Consumers:

WALLET_PERSONAL - Businesses:

WALLET_BUSINESSorWALLET_INSTITUTIONAL

Contact your Partner Manager to confirm which type applies to your product.

There are two ways to fund a restricted account.

The customer sends a standard bank transfer from their external bank account to the Restricted Account's IBAN.

The Auto-Link Logic:

- Receipt: Solaris receives the incoming SCT.

- Validation: Solaris compares the Sender Name (from the SCT) with the Account Holder Name (on the Restricted Account).

- Outcome:

- Match: The funds are credited, and the sender's IBAN is automatically stored as a verified Reference Account.

- Mismatch: The transaction is rejected and returned.

Customers can instantly fund their restricted account using a debit or credit card (or Apple/Google Pay). This is faster than SEPA and improves conversion.

List Reference Accounts Retrieve all external accounts linked to this restricted account.

GET /v1/persons/{person_id}/accounts/{account_id}/reference_accountsCheck Rejected Pay-ins If a customer claims they sent funds that never arrived, check the rejection log (usually due to a name mismatch).

GET /v1/accounts/{account_id}/rejected_incoming_transactionsCustomers can withdraw funds only to a verified Reference Account.

Prerequisite: The transaction requires Change Request authorization (SCA).

Call this endpoint to create the payout request.

SCA Flow: The API returns 202 Accepted with a change_request_id. You must use this ID to complete the Change Request process. Once confirmed, the payout executes.

// POST /v1/accounts/{account_id}/reference_account_payouts

{

"reference_account_id": "d5325027ca2840d4b3a97b8ec8b837f0racc",

"amount": { "value": 100, "currency": "EUR", "unit": "cents" },

"description": "Withdrawal to main bank",

"reference": "unique_payout_ref_123" // Idempotency key

}Response (202 Accepted):

{

"id": "d6c778822b2d7bd3b778935bcfd02d1d3csc", // Use this Change Request ID

"status": "AUTHORIZATION_REQUIRED",

"url": "[https://api.solaris-sandbox.de/v1/change_requests/.../authorize](https://api.solaris-sandbox.de/v1/change_requests/.../authorize)"

}You can list all payouts or retrieve a specific one by ID.

GET /v1/persons/{person_id}/accounts/{account_id}/reference_account_payoutsCustomers can transfer funds between two restricted accounts they own (e.g., moving funds from a "Euro Wallet" to a "Crypto Settlement Wallet") using the Transfer Request process.

This is a 3-step process designed for transactional safety:

- Reserve: Block the funds.

- Execute: Move the funds (partial or full).

- Resolve: Release any remaining reservation.

This creates a Reservation on the account. The funds are blocked but not moved.

// POST /v1/accounts/{account_id}/transfer_requests

{

"amount": { "value": 10000, "currency": "EUR" },

"description": "Reservation for Crypto Buy",

"reference": "unique_ref_123" // Idempotency key

}Returns: reservation_id and id (the transfer request ID).

Move the funds to the target recipient. You can execute less than the reserved amount.

// POST /v1/accounts/{account_id}/transfer_requests/{transfer_request_id}/executions

{

"amount": { "value": 10000, "currency": "EUR" }, // Can be <= reserved amount

"recipient_iban": "DE32110101001000000029",

"type": "CRYPTO_EXCHANGE", // Enum: CRYPTO_EXCHANGE or PARTNER_FEE

"reference": "unique_exec_ref_123"

}If you executed less than the reserved amount (or canceled the operation), you must call this endpoint to release the remaining blocked funds.

PATCH /v1/accounts/{account_id}/transfer_requests/{transfer_request_id}/resolveTrack the status of reservations and executions.

Returns all transfer requests (Reservations) for an account.

GET /v1/accounts/{account_id}/transfer_requests?filter[resolved]=falseRestricted accounts require standard reporting. You must provide customers with a Statement of Account (SoA). See the Account Management guide for implementation details.